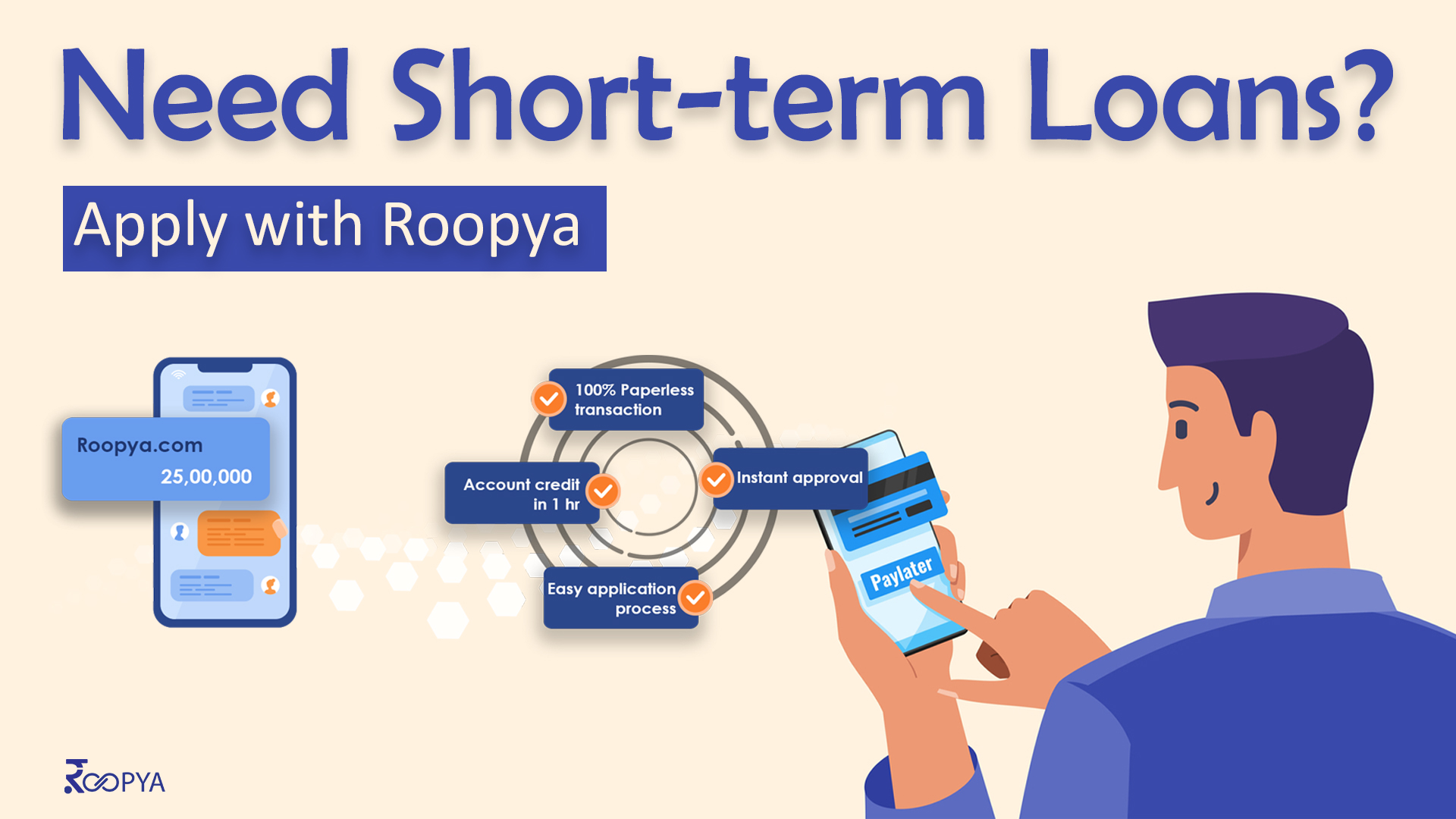

Get instant personal loans for short term in just 1 hour. Apply now with Roopya & get loans up to 25 lakhs without any physical documentation.

When you avail of this short-term personal loan, you can easily pay off any emergency financial needs. To get the loan instantly, with minimum documentation, short-term loans are a great option. You can easily apply for a short-term loan online, or from any bank in India.

Within a few steps, your loan amount is transferred to your account after verification. To know more, we will discuss short-term loans, benefits, features, eligibility, the loan application process, and many more.

What is a Short Term Personal Loan?

As it is discussed above, loans for the short term are offered for a few days to a few months or years. You can apply for a short-term loan ranging from Rs. 10,000 to up to Rs. 25 lakhs.

However, the amount of the loan depends upon your financial requirements and other factors.

How can you apply for Short Term Personal Loans?

You can easily apply for a short-term loan with Roopya.

Apply here: Personal Loan Application Form

EMI Calculator for Personal Loan

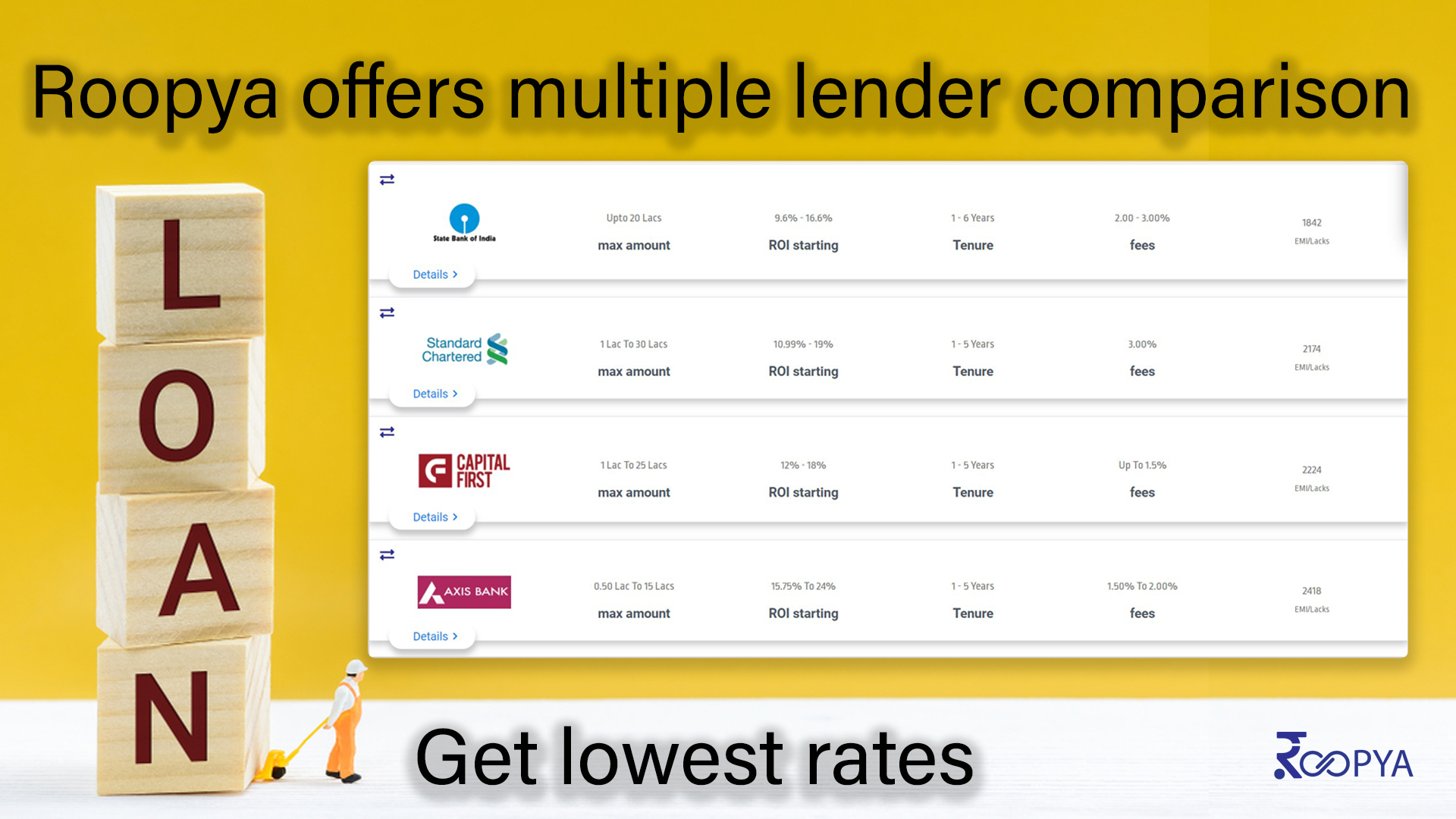

You can check the amount of EMI online. The loan EMI Calculator will help you to understand how much EMI you need o pay for your loan. With the EMI calculator, you can also check your eligibility beforehand. You can also visit roopya.com to compare short-term loans instantly with different banks.

Calculate now: EMI Calculator

Documents Required for Short Term Personal Loan

The documents required for short-term loans are minimal. You will require the following documents to apply for the loan.

Identity Proof

These are the following documents that you need to submit for your identity proof-

- Aadhaar Card

- Driving License

- Voter ID Card

- Recent Passport Sized Photograph

- Others

Address Proof

You will require any of the following documents for your address proof.

- Voter ID Card

- Driving License

- Aadhaar Card

- Passport

Income Proof

For Income proof, you will need the following documents.

- Recent Salary Slip of last 3 months

- Bank Statement of last 3 months

Looking for a particular city? Read: Personal loan in Bengaluru | Personal loan in Pune | Personal loan in Delhi | Personal loan in Hyderabad | Personal loan in Kolkata

What are the Features and Benefits of a Short-Term Personal Loan

These are some features that you must know about a short-term personal loan.

No Need of Security and Collateral

Short term personal loans don’t require any security. That’s why it is also known as an unsecured loan. So, if you don’t have any collateral, you can still apply for this loan easily. The process is very easy and your loan gets easily approved as well.

Easy Disbursal

The personal loan amount gets easily disbursed to your account without much hassle. It means unlike the traditional loans, you don’t have to wait for several days for approval. As soon as your application is approved, the amount is disbursed to your account in a few hours.

Minimal Documentation

To get a short term personal loan, you don’t need to submit excessive documentation. The process is extremely simple and fast. Thus, you get the desired amount with less documentation for your loan application.

Multi-Purpose Loan

A short term personal loan is also known as a multi-purpose loan. So that you can easily use it for various purposes such as business expansion, home renovation, family vacation, education, medical emergency, etc. So if you need a loan instantly, you can visit our website roopya.com.

Short Duration

The loan tenure or period of short term loans ranges from 1 month to 1 year. The short period helps you to repay the loan fast and easily. The bigger the amount, the larger the tenure. Hence, you must make sure that you pay EMIs on time.

Easy Processing

People largely opt for short term loans directly. They want to cut off the intermediaries or credit brokers. It is because to avoid the delay from the broker’s side. Apart from that the fast verification process with online facilities is one of the major features of a short-term loan.

Amount of the Loan

If you are in urgent need of money, then a short term loan is best. The amount of short-term personal loans ranges from Rs. 5,000 to Rs. 3,00,000. You can choose the loan amount according to your requirement. If your application is approved, you will get the loan amount in your bank account directly within a few hours.

Transparency

The short-term loans do not incur hidden charges. It makes the process easy and builds trust between the borrower and the lender.

Tips for Applying Short-Term Loan Online

If you want to apply for a short-term loan, then we have listed a few steps. With the following steps, you can easily understand how to apply for it easily.

- Compare different lenders available online- Firstly, you need to compare different lenders to get the best idea. Research the interest rates, late payment fees, processing fees, hidden charges, terms and conditions, etc. Apart from that, don’t forget to check the terms for repayment. Try to resolve any confusion beforehand to avoid any problems. You can also visit roopya.com to instantly apply for a short-term loan online.

Quick links: Compare Personal Loan Interest Rates

- Choose the loan suitable to your requirement-Secondly, after you have compared different websites, the next step is to choose the right amount for your loan. It is best to calculate the loan amount you need for short-term loans.

- Fill in the application form-Thirdly, you have to fill in the application form. You have to be extremely careful while doing this. You will have to fill in the details such as name, address, pan details bank account, tax returns, etc.

- Upload your document-After filling the application form, you have to upload documents. The upload of documents is necessary for short-term loans. This will require proof of identity proof of income and proof of address.

- Submit The Application-Finally, after you successfully fill the form you have to click on submit and wait for the approval. Remember to check all the details once again before clicking on submit.

- Get the amount disbursed in your account- If your loan gets verified and approved by the loan provider, the amount will be disbursed directly to your bank account. You will receive the loan amount generally with a direct deposit. The time for the loan disbursal can differ on the basis of the loan amount. It can take a few hours to a few days as well.

Which Bank Deals Short Term Loan?

There are various banks that offer short-term loans easily. We have listed some of the popular banks in India that can provide the loan easily. You can apply for a short-term loan from any of the following banks.

Axis Bank-

- 1 year 9.20%

- 2 years- 9.30%

- 3 years- 9.35%

Bank of Baroda

- 1 month-9%

- 3 months- 9.05%

- 1 year- 9.30%

- 3 years- 9.35%

- 5 years- 9.05%

Punjab National Bank

- 1 year- 9.40%

- 3 years-9.55%

- 5 years- 9.70%

HDFC Bank

- 1 year-9.20%

- 2 years-9.30%

- 3 years- 9.35%

State Bank of India

- 1 year-9.20%

- 2 years-9.30%

- 3 years- 9.35%

Canara Bank

- 1 year- 9.40%

- 5 years- 9.70%

What are the Types of Short Term Loans?

Before we move further, it is very important to know about the different types of short-term loans. To know more details about its types, read below.

Cash Advances from Merchant

This type of loan is similar to a cash advance. A lender will provide you with the loan that you need. The borrower will allow him to access the credit facility until the loan amount is paid. Every time a customer makes a purchase from the borrower, a significant amount is deducted by the lender.

Payday Loan

A Payday loan is one of the easiest short-term loans that you can avail of. In this loan, you will pay the loan amount on the day you receive your salary. The loan amount, along with the interest, will be deducted into a single amount. The amount will be deducted directly from your bank account. However, one drawback of the payday loan is that it incurs an increased interest rate.

Financing of Invoice

The interest rate in invoice financing is charged on the basis of the number of weeks the invoice is not paid on time. When you will pay the invoice, the loan provider or lender will take the interest and return the amount to the borrower.

Installment Loan

An installment loan is also known as an online loan. Now, it has become popular because the whole process is done online. You can find various websites available online that provide the instant loan within a few minutes. With minimal documentation, your application gets approved and the money will transfer to your bank account. The whole process can take up to a few minutes or hours.

Bank Overdraft

The bank overdraft facility is also offered by the banks. If you have a current account then you can enjoy the overdraft facility. So, if you have insufficient funds, then the bank will provide you with a significant amount that you can withdraw. However, they will charge you interest on the loan amount.

Eligibility to Apply Loan for Short Term

You need to meet the eligibility criteria to apply for a personal loan. Read the information below that we have listed for you to apply for the personal loan.

Nationality- If you are an Indian, then you are eligible to apply for a short-term loan. Even if you are a Non-Resident Indian (NRI), you can apply for a short-term loan easily.

Income- You must be a self-employed or salaried individual. Along with that, if you are a salaried individual, then you must have an income of at least Rs. 15,000 monthly.

Age- The minimum age to apply for a short-term loan, should be between 21 years to 60 years. This criterion is applicable for both self-employed and salaried individuals.

You must know that the eligibility criteria differ from one financial institution to another. So, don’t forget to check the criteria before applying for a short-term loan.

Charges & Fees of Short Term Personal Loan

After you get the approval of the loan, you need to pay some charges. It includes processing fees, late payment fees, interest rates, penalties, etc. Read below to know about it in detail.

Late Payment Fees- It’s just like when you have to pay the late payment fees for secured loans. You have to pay the late fees when you fail to pay the EMI on time. Thus, you must pay the EMI on time for your instant personal loan. The late fees can differ from one loan provider to another. Apart from that, you can also check the late fees of every loan provider online.

Processing Fees- After you complete the verification process, you have to pay the processing fees. The amount of personal loans is very low. It generally ranges between 0.5% to 2.50% of the total loan amount. Apart from that, you will have to pay the GST along with the processing fees. Just like other fees and charges it can differ according to the loan amount and the financial organization. On the other hand, various banks offer loans without charging any processing fee.

Penalty Charges-After the processing fee, there are penalty charges that you need to know. There are some late payment penalties, prepayment penalties as well. Yes, if you want to repay the loan in advance, then you will have to pay a prepayment penalty. The amount of prepayment penalty can differ due to various reasons and funds. Moreover, many banks don’t charge a penalty of prepayment as well. For that, you must deposit an increased amount of your EMI.

Interest Rates- The important thing that you need to check is the interest rates. The rate of interest rate also varies for every lender. You should know that the interest rate is finalized depending upon the loan amount. Also, the money outflow in the personal loan is way cheaper than the long-term loan. That is why getting a short-term loan is way cheaper. So whenever, you are going to opt for a short-term loan, check the interest rates accordingly.

Other Places to Apply for a Short Term Loan?

Apart from Roopya, there are various other places as well. We have listed some other places where you can easily apply for Short Term Loan.

Banks-Banks also offer personal loans at different interest rates. You must enquire about the loan and the required amount. If you have some time in your hand then, you must try to apply for a loan from the bank.

Payday Lenders- The payday lenders offer loans at a small amount. For this, you have to pay the loan amount on the next payday. But, the interest rate can range from 30% up to 50% APR. Thus, this should be the last option to apply for a loan.

Credit Unions- The credit unions are basically non-profit organizations. They offer short term loans at a low-interest rate as compared to banks. However, to obtain a loan from the credit union, you first need to become a member of the credit union.

Online – Now, you can find various websites that offer personal loans to customers easily. It is only possible due to the online process. It is faster, cheaper, and most importantly, convenient. You can directly visit the website of the lender. Then, check the loan section and select the short-term loan. After that, you need to fill in the information, documents, and that’s it. The lender will approve your application then you will receive the loan amount. With the online process, you don’t need to worry if you have an urgent requirement of money at any time.

Customer Care Service-If you are not able to apply for a loan online, then you can also call the customer care service. Ask the executive to help you for applying for a short-term loan. Listen to steps carefully, if possible note them down. In this way, you can manage to apply for a loan.

Downloading the App- Now, other than the website, lenders also have their mobile applications. If you have a smartphone, then the process will be equally easy. Download the app of the lender. You can easily complete the whole process through your mobile phone. Also, don’t need to worry about the submission of the documents. You have to upload the softcopy of the documents and you are done.

Alternatives to applying for short-term loans are-

Credit Cards- If you have a credit card with you, then you can opt for a personal loan from your credit card. Apart from that, if the financial emergency can be sorted with a credit card, you must opt for it.

Take help from friends and family- This is the first option for everyone when we fall into a financial crisis. But, before taking a loan from them, you must talk to them properly about the repayment of loan. Furthermore, you must take the decision seriously and pay off the debt on time. If you fail to do so, then it can hamper your relationship with them.

Get Home Equity– If you need a huge amount of money, then you can get equity of your home. But remember, the application process for this type of loan is long. Generally, it can take several days or weeks. So, if the need is not urgent, you can opt for this solution.

Increase Your Chances to Get a Personal Loan

If you feel that you have low chances of obtaining a loan due to a low credit score, income, etc. Then you must take certain steps. Follow the below steps to increase your chances to get a personal loan online.

Find the Right Lender-You need to find the right lender that suits your requirement. For that, you must fit in the eligibility criteria set by the lender. Applying to more lenders at a time, can affect your credit score. That’s because, every time the lender checks your credit score, it will drop significantly. So make sure that you are applying to the right lender before finalizing.

Balance the Ratio of Debt and Income- Secondly, you need to make a balance of your debts and income. Otherwise, it can decrease your chances of getting a short-term loan. try to increase your annual income and clear all your debts on time. If you keep this thing in mind, you can easily avail of the short-term loan in the future.

Increase Credit Score-Another important step to increase your credit score is important that you increase your credit score. To avail of any type of loan, you need to have a good credit score. Sometimes, it happens that minor errors can affect your CIBIL score, Make sure to identify the errors and improve them on time. Apart from that, you must pay your EMIs on time. Because non-payment of a loan can affect your CIBIL score drastically.

Read more: Credit score in India

Find a Guarantor-Additionally, if you are still unable to find a lender for a loan, then you can find a guarantor. It can be your friend or a relative, etc. that can become a guarantor. The main purpose is that the person will guarantee you that will pay the loan. but, make sure that whoever you are assigning as your guarantor, must have a CBIBL score of more than 750. Thus, you can easily increase the chances to get a short-term loan.

Apply for Right Amount-You need to be strict about applying the right amount. If you apply for an increased amount, then it can be a risky task. To avoid that, you must calculate the right amount you need for the loan. Moreover, it can also help you to pay off the loan easily on time.

What are the Disadvantages of Short Term Loans?

As we have discussed the different types of short-term loans and their benefits, we need to understand the disadvantages of short-term loan. Below we have listed various disadvantages of short-term long.

Increased Interest Rate

When you apply for a loan with less amount, then the interest rate will increase simultaneously. It is one of the major disadvantages of short-term loan. So, whenever you apply for it, check the interest rate beforehand to get the best deals.

Negative Impact on Credit Score

You may not know, but another disadvantage is that it will hamper your credit score. You may fail to repay the EMI on time, but it can be a huge drawback. The credit score can drop down if fail to clear the loan before the estimated due date. To avoid this disadvantage, make sure that you clear all your loans and pay EMIs on time.

Penalty for Early Repayment

As we all know that we have to pay a fine for late payment. But, even if you try to pay the loan before the time, then you also need to pay the penalty. It is also known as the early prepayment penalty. However, there is some lender who will not charge a penalty for the prepayment. hence, you must clear all the confusion regarding this prepayment of loan.

What is the Difference Between Short-Term Loan and a Long Term Loan

Generally, the application process to apply for a short-term loan is easier than the long term. If you are confused about between short-term loans and long-term long, then you can solve it here. Read below to understand the difference between the two.

Eligibility Criteria-The criteria for loan eligibility for the long-term loan us stricter as compared to the short-term. You need to have a good CIBIL score of at least 650. On the other side, you can easily apply for the short-term if you have a stable monthly income of at least Rs. 15000.

Rate of Interest-The rate of interest for short-term is higher. But, when you opt for a long-term loan, the rate of interest is low.

Loan Tenure- The loan tenure of a short-term loan is small as compared to the long-term loan. It generally ranges from 1 year to up to 3 years. But, the tenure of the long-term loan begins from 3-5 years and lasts up to 10 years or more. The main reason for the low rate of interest for long-term loan is the long loan tenure.

Documentation Process- The process of documentation for the short-term loan is fast and easy. You will need minimal documents and within a few minutes, the verification process will be complete. Furthermore, if you want to get a long-term loan, you have to submit various proofs and documents. This can take a few weeks as well.

Time of Disbursal-The disbursal time after you apply for the long-term loan can take around one or two weeks approximately. But, it is totally the opposite for short-term loans. Because the amount can be disbursed within a few hours. Thus, within 24 hours, you will receive the amount in your bank account.

Conclusion

In conclusion, short-term loan is best if you have an urgent need for money. You can use it for different purposes such as education, marriage, home renovation, family vacation, etc. interest rates for a short-term loan are set higher because they have a short tenure.

Generally, the tenure of a short-term loan is between 1 year to 3 years. These types of loans don’t require any collateral that is why are also known as unsecured loans. You can apply for a short-term loan from a bank as well as online.

The process of applying loan is easy and fast and you get the desired loan amount with minimum documentation. So, if you have an urgent need for a loan, then short-term loan is a benefit.

42,493

Leave a Comment

Your email address will not be published. Required fields are marked *