Are you looking for unsecured loans? You have come to the right place. Here at Roopya, we will provide you with the information you need to know about unsecured loans.

Roopya not only provides you with instant personal loans but also helps you compare various lenders for a better deal.

How to apply for unsecured loans?

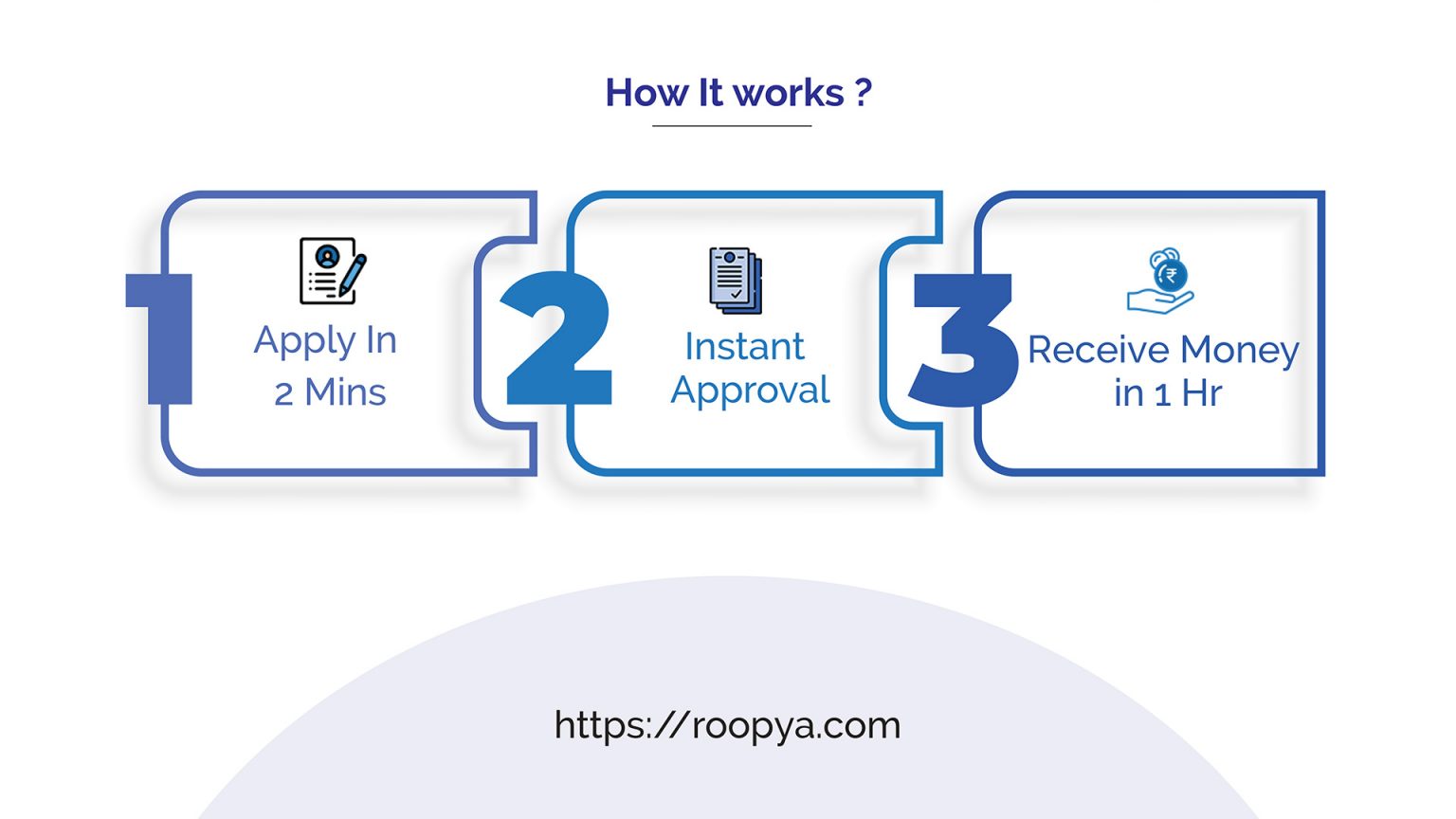

With Roopya, it’s frickin easy to apply for an unsecured loan. You just need to follow these simple steps.

- Visit: Personal loan application form

- Just follow simple steps & fill in a few details.

- Get instant loan approval & receive the loan amount directly to your bank account.

Not sure about us? Read reviews from our satisfied customers.

Reference: Roopya google reviews

What is an Unsecured loan?

Unsecured loans are those loans that don’t need collateral. When you apply for a loan, you have to provide security such as property, vehicle, etc. to the bank. This type of loan is also called a secured loan.

Quick links: Compare personal loan lenders

But, to avail of an unsecured loan, you don’t need to provide security. That’s why they are also known as unsecured loans. Because you just need to provide verification documents to apply for the unsecured loan.

It is upon the discretion of the lender to approve or reject the loan application of the borrower. However, the borrowers must have a high credit score if they want to get an unsecured loan from any online lender or bank.

If you are borrowing an unsecured loan for yourself and fail to pay the debt on time. This will highly affect your credit score.

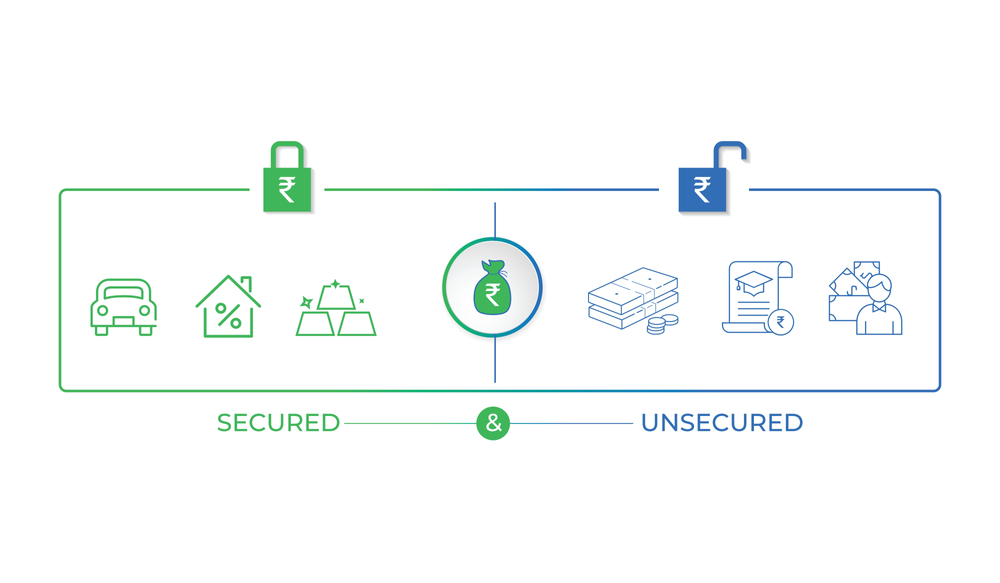

What is the Difference between Secured and Unsecured Loans?

When we discuss secured and unsecured loans, the main difference is the collateral. As it is already mentioned that you don’t need to provide any security or collateral for an unsecured loan.

But, if you are opting for a secured loan, you need to provide collateral which is necessary. The secured loans have various financing options such as home equity, car loans, mortgage, etc. for a personal loan.

Along with that, you can easily get approval for the secured loan. But on the other side, it can be tough to achieve an unsecured loan. It is mainly because they don’t have much financial risk for the lender. So, when you are going to get a personal loan for yourself, choose according to your requirement and other factors as well.

Is An Unsecured Loan Safe?

If you pay the EMIs on time, then there is no problem. But, if you fail to repay the loan amount on time, it will have an adverse effect on your credit score. This factor can reduce your chances to apply for loans in the future.

How Do You Calculate Interest On An Unsecured Loan?

To calculate the interest of an unsecured loan, use the EMI calculator. They are easy to use and available online. This will show instant results for your interest and the EMI that you need to pay for your personal loan amount.

Reference: EMI Calculator

Thus, it is important to pay the EMI according to the agreed terms and conditions between the lender and borrower. Hence, to make an unsecured loan safe, you must pay the EMI on time.

Due to the high risks, the interest rate of this unsecured personal loan is also high. After your credit score drops down, it can be very difficult to obtain a loan in the future.

So, do the right calculation even for future circumstances to pay the EMIs on time for the type of loan you want.

When You Should Use Unsecured Loans?

Whichever type of loan you want to apply for totally depends upon your financial conditions. If you want money but don’t want to provide collateral, then you can definitely choose the unsecured loan. You can use this type of personal loan for different uses.

You will need an unsecured loan when you:

Use it as a Consolidating Debt

One of the major reasons to use unsecured loans is for debt consolidation. You can apply for a loan and then use it for paying other credit card bills and other loans. In this way, you can streamline the personal loan process and the process becomes easier. Along with that, you can easily pay off the loan with low-interest rates. Hence, if you have various sources of debts that have high-interest rates, then you must opt for this solution.

A Good Score of Credit

If you have a good score of credit, then you can easily apply for an unsecured loan. As we have already discussed that availing of an unsecured loan is already difficult. For that, you must have a good score of credit. Along with that, you can avail the unsecured loan with a low rate of interest if you have a higher score. But, if you fail to the EMI on time, then your score can drop significantly.

Planning for a Purchase

If you are planning for purchase, such as a home renovation, then you must apply for an unsecured loan. Along with that, if you are planning for a medical procedure and unable to find other types of loans, then you must try this. However, whatever purchase you make, you should be sure that you are using the money carefully.

Why is An Unsecured Loan Bad?

An unsecured loan is considered bad because it is tough to avail. If you want to get an unsecured loan, you need to have a good score of credit. However, if you want to get a loan with a low score of credit, the rules will be a more strict and high rate of interest. They may also ask you to bring a guarantor. So, if you fail to repay the unsecured loan, the guarantor will be held liable to pay the loan.

So you must know the disadvantages of unsecured loans in the beginning. These are some disadvantages of unsecured loans.

- It is hard to get approval for an unsecured loan because it doesn’t require collateral.

- It can lead to a low score of credit if you fail to pay the EMI on time.

- The interest rate will also be higher if you have a low score of credit.

- There are chances that you can lose your assets.

Other options to get an unsecured loan:

When you are in urgent need of money, then an unsecured loan is a great option. You can borrow money ASAP from any recognized banks in India or other online lenders at a considerable rate of interest. Here are the various places from where you must try to avail of unsecured loans.

Banks

To get the best deals and instant unsecured loans, Banks are the first option that comes to our minds. To get an unsecured loan, you need to have a bank account with them. So if you already have one, it will become easier to apply for a loan. but, you must check that if the bank offers an unsecured loan or not. Generally, banks offer loans with a huge amount with a low rate of interest.

However, to be eligible to get an unsecured loan, the borrowers must have a good CIBIL score. Along with that, you need to visit the bank to apply for an unsecured loan.

Online Lenders

Secondly, there are various lenders available online. They also offer a pre-qualification process for the borrowers. For that, you need to submit your personal details and you will instantly get a review of the loan amount that you can get. Due to this process, your credit score remains unaffected and you get an unsecured loan with minimal documentation.

Credit Unions

Another place to get an unsecured loan is from credit unions. These credit unions are basically non-profit organizations that offer unsecured loans at an appropriate rate. After applying, the amount is disbursed as soon as possible to your bank account.

What Is An Unsecured Interest?

The interest rate which is implied on an unsecured loan is also known as unsecured interest. The rate of unsecured interest varies from one lender to the other.

The lowest rate of interest on unsecured loans is 9.2%.

This can further increase by up to 36% as well. However, the rate of interest largely depends upon the tenure of the loan. The tenure can range from 12 months to up to 60 months.

So, if you opt for a shorter loan tenure, the unsecured interest will be high. Simultaneously, the rate of interest rate will be low with the increasing loan tenure.

Do Unsecured Loans Have A Higher Interest Rate?

Yes, It is already mentioned that unsecured loans have a high interest rate as compared to others. It is mainly because there is no requirement for collateral.

So, it is totally on you if you want to choose unsecured loans from any financial institution. Make sure that you are aware of the regulations and other important information. So, don’t forget to pay the EMI on time to maintain a good CIBIL score.

What are the important criteria to easily get an unsecured loan?

Unsecured loans are majorly risky for the lenders. Thus, to ensure that you will repay the debt on time, they will check several factors. So, when you are going to apply for an unsecured loan, you must check the following factors.

Income of the Borrower

To apply for any type of loan, income is one of the main criteria that a lender checks. You will have to several proofs that you have a stable income. In this way, the lender will be sure that you can pay the amount easily on time.

Credit Reports of the Borrower

Secondly, the credit report is another factor that lenders consider. They will go through your credit reports to look at your past loans. Mostly, they will look after your credit history of past one year or more than that. Along with that, the bank or the lender will also check the credit score. For that, you need to have a score of at least 700 or more than that. You just need to understand that the more your score is high, the chances of getting a personal loan become easy at the best rate of interest.

Assets

However, if you apply for an unsecured loan, then you don’t need to give any collateral to the lender. But, it may happen that they want to know that you have enough savings so that you can pay off the loan.

Debt-Income Ratio

Another main factor that the lenders look upon is the income debt ratio. It is very when to calculate the debt-income ratio. For calculating that, you need to add all your monthly debt and then divide it with your monthly income. Hence, this formula is largely used by the banks and lenders to get an estimate of your debt-income ratio. The ratio can vary from one lender to another, but it doesn’t exceed 43 percent.

Which Bank Gives Fastest Personal Loan?

Want to get a personal loan in the fastest way possible? Then we have already made a list for you. The following list will give you adequate information about the personal loan offered by top banks in India with adequate interest rates. Read below to know more.

- HDFC Bank– 11.25%-21.50% per annum.

- ICICI Bank– 11.25% per annum and onwards

- IDFC First Bank– 12% per annum

- Yes Bank– 10.75% per annum onwards

- State Bank of India– 12.50% per annum onwards

- Axis Bank– 15.75% per annum onwards

- Allahabad Bank– 13% per annum onwards

It is best to visit our website roopya.com. Here, you can easily compare the personal loans offered by different banks and apply for them directly. Furthermore, to get a better idea, you can also calculate the EMI of your personal loan.

Good to Know Facts about Unsecured Loans

To apply for an unsecured personal loan, you can follow the below steps.

Know the Estimated Loan Amount

The first step to applying for an unsecured loan is to know the required amount. If you borrow more than what you really need can increase the financial burden. To avoid the problem you must take the required amount as a loan. Even if the lender or the bank offers you a high loan amount, you must stick to what you need.

Do Adequate Research

After you have determined the loan amount, the next step is to do proper research. You need to find out those banks that give you the right amount of loan at the right interest rate. You can easily opt for an unsecured loan from local banks, credit unions, national banks, and other online lenders.

Compare different types of offers for personal loans

After you complete the research, you need to compare the amount, interest rates, terms and conditions, other features, for the personal loans. When you find the right lender that fits your criteria, you can proceed to apply.

Submit the application for a loan

The next step is to submit the loan application for unsecured personal loans. This process can now be done online. So take your time and fill in the application form properly. Make sure that there is no error. Otherwise, it can create confusion afterward.

Provide the documents

After you submit the application form, the lender or the bank will ask you to provide the important documents to get the personal loan. Don’t take much time to submit the documents for personal loans. It may happen that they will ask for other documents. So, make sure that you are ready with them for the documentation.

Accept the amount

After the submission of a loan application, the bank or lender will tell you how will you receive the loan amount. The money will be disbursed to your account directly or through a cheque.

Hence, the above information related to unsecured personal loans will be helpful to understand in detail. You can visit our website roopya.com to get compare different unsecured personal loan apply directly. The online application process is easy and with minimal documentation, the desired amount of a personal loan is disbursed to your account within a few hours.

Furthermore, before applying, read all the terms and conditions before availing unsecured loan and avoiding any confusion.

42,557

Leave a Comment

Your email address will not be published. Required fields are marked *