Personal Loan in Kolkata: Get an instant loan in just 1 hour. No physical documents are required.

Kolkata, the city of festival, celebration, and traditional heritage. Moreover one cannot miss the striking contrast between ethnicity and old British charm.

Being one of the top metropolitan cities and a prime commercial hub of East Indian life poses many challenges. Financial need interrupts any time in our life leaving us in a helpless condition. In addition, economic stability brings a better lifestyle and one can easily meet their dreams.

Personal loans empower you with all potential financial needs. Personal Loan in Kolkata is one of the most convenient financing options. Lenders including top banks and non-banking financial companies offer flexible personal loans at competitive interest rates which start from 5.00% with convenient tenure and easy EMIs.

The best part about personal loans is, you can use them for various financial needs. Starting from paying your medical bills to repay a debt, one has the choice to use them for various purposes.

To know more about the details of personal loans, please keep reading the whole article.

Easy Apply: Personal Loan Application Form

How do I apply for a personal loan in Kolkata?

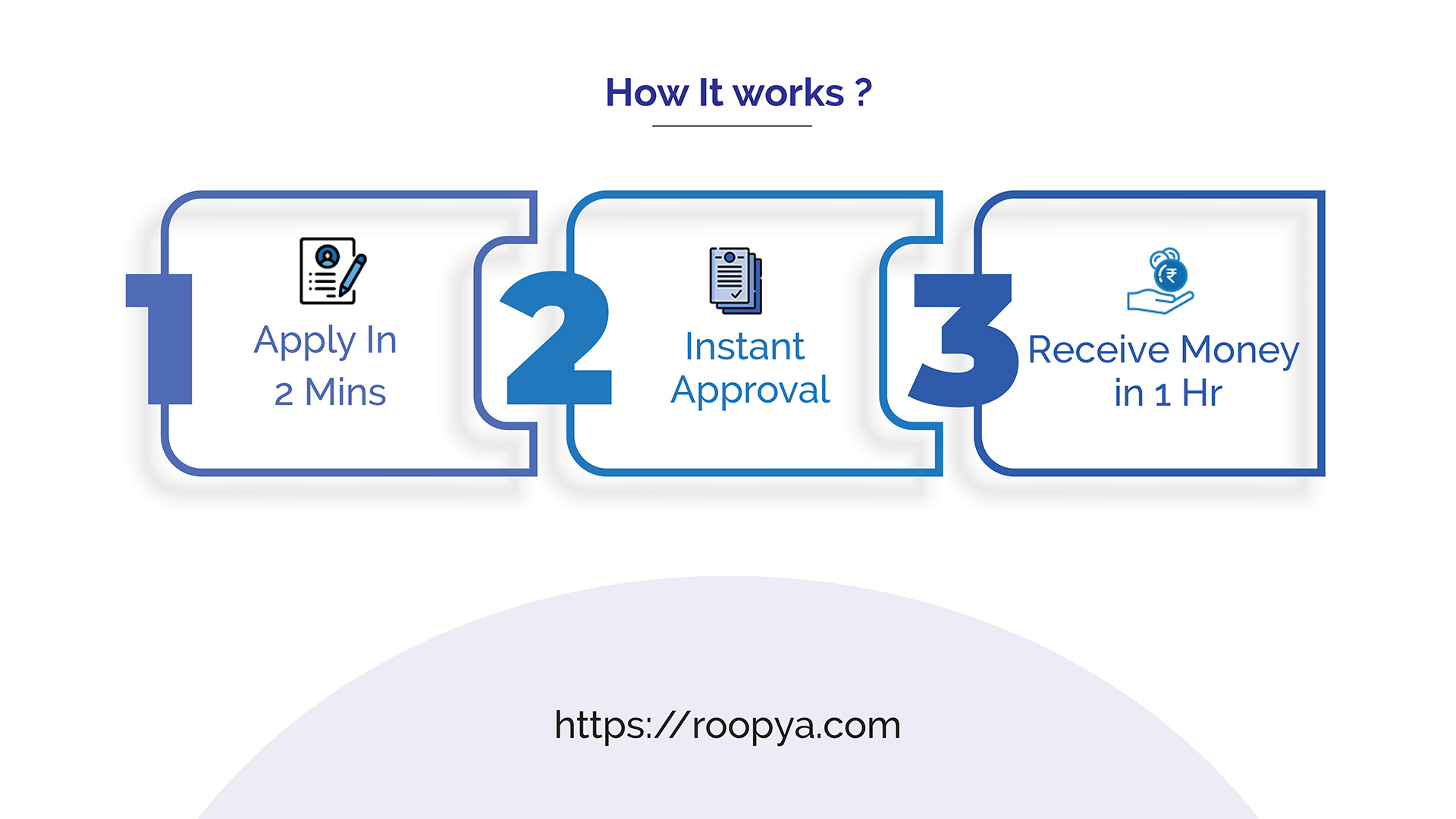

Applying for a personal loan is very easy with Roopya. To apply for a personal loan online, you need to follow the below steps-

- Visit: www.roopya.com

- Go to the “Personal Loan” option and click on “Apply Now” for loan application.

- Then follow the steps accordingly and fill in all the details such as name, address, PAN Card details, phone number, email id, etc.

- Then you need to upload the documents required (bank statements, ID proof, credit information, salary slips, etc) for verification with the loan application.

- After completion, the representative from the respective organization will call you for further verification and other details.

Once you apply for the personal loan program we will start accessing your documents. Based on your documents and requirement we will proceed to the final stage. It hardly takes 1 hour to process your loan request.

How would I get a Personal Loan with the lowest interest rate in Kolkata?

A great many people like to apply for personal loans in the banks where they maintain their compensation accounts, as the approval process turns much simpler. While it tends to be considered as a possibility for quicker authorizing of loans, comparing and choosing the most appropriate loan is generally attractive.

Quick Link: Compare Personal Loans

Your personal loan eligibility is affected by various factors which can likewise affect the interest rates presented to you. So in the event that you intend to avail of a personal loan at a low interest rate, here are a portion of the key regions you need to view:

Credit score

Make sure that you maintain a decent credit score prior to applying for a personal loan. A decent credit score increases your chances of getting an unsecured personal loan, which might even come as pre-qualified loans. For the most part, a credit score of 750 is considered good for availing of personal loans.

Read more: Credit Score Checklist

Make an upfront installment

Paying out a huge piece of the loan amount is probably going to decrease your charges to an impressive scale. Any amount above 20% of the loan esteem, paid forthright, will decidedly affect the interest rates on your loan.

Debt-to-pay proportion

Debt-to-pay proportion is a proportion of the singular’s capacity to reimburse the personal loan. It is a critical determinant of your eligibility for personal loans. Guarantee that you have a consistent debt-to-pay proportion prior to moving toward a bank or NBFC for personal loans.

Loan comparison

Optimizing the utilization of monetary entrances, for example, BankBazaar will help you when looking for loans offering wellbeing rates. The BankBazaar website looks at the loan interest rates of all its accomplice banks and makes it simpler for clients to pick the most appropriate item.

Tenure

The loan tenure straightforwardly affects the interest rates charged on your personal loan amount. Thusly, choosing a short tenure will give you less interest rates and vice versa.

Employment status

Your employment likewise plays a part to play in the approval of your personal loan. Banks consider your work experience and the details of your boss while reviewing the loan application. So on the off chance that you work for a company recorded with the bank, you have higher chances of getting personal loans for a limited interest rate.

Personal loan negotiation

It’s a well-established reality that a great many people settle for the interest rates presented by the bank. Yet, to avail better rates of interest, negotiation is an objective. So in case you are somebody applying for a loan at a bank where you holding your compensation account, then, at that point, you have a higher chance of making a negotiation.

Using these tips you can get personal loans in Kolkata at a low interest rate. However, you need to check all the details and hidden fees related to the loan amount before opting for one.

Reasons to apply for Personal Loan in Kolkata

An urgent financial need always pops up amidst the most unexpected time. In such an adverse situation, how would you manage to arrange a lump sum amount overnight? You should keep a convenient option available to have easy access to cash.

The best part is, as Roopya is designed for a quick solution, the lenders don’t ask for any collateral and easily offer the credit amount. You might have different circumstances where a quick credit amount can save you from huge losses. Let us look at the top six reasons why you should opt for a personal loan.

Paying credit card loan

Credit card loans are exorbitant. This is a reality. It very well may be intended for shopping or some spending while on an abroad trip. On the off chance that you spend a great deal of the credit card, repayment can be a major issue. With yearly interest rates of 40%, this is a very costly debt to convey for long. Subsequently, utilizing a personal loan, which conveys yearly interest rates of 12-15 percent, is a much brilliant choice. You save money on interest expenses and leave your credit history flawless.

Can’t ask relatives or family for money

Numerous borrowers come from wealthy families. To them, getting a loan isn’t an issue. The issue is had the chance to do with the prevailing difficulty of having taken a loan from family. A loan taken from a kin or a parent can be free for example no interest will be charged.

Notwithstanding, the relationship might become uncomfortable in the wake of taking the loan. A few relatives can openly discuss loaning you money, causing shame. Taking a personal loan from a top monetary moneylender, as IDFC Bank, implies no one thinks about the loan exchange. It’s confidential.

When purchasing a home

It’s undeniably true’s that a home loan covers 80% of the house cost. Thus, mortgage holders are relied upon to pay 20% from their pocket. Additionally, enlistment, lawful charges, and other duties might cost another 15-20 percent. On the off chance that you have needed to spend your investment funds corpus for another explanation, you will require a loan to cover these additional subsidizing necessities. Your yearly reward might be sufficient to reimburse this little loan, however that reward is 8 months away.

This is the place where taking a personal loan bodes well. With very few documentation standards, one can apply for a personal loan and get it.

Health-related crisis

You might have a strong clinical protection strategy yet that doesn’t mean you are 100% covered. Hospitalization costs are excessive. As it occurs, the approach aggregate guaranteed limit is typically penetrated because of clinical expenses. A significant medical procedure that could be life-saving might require you to promptly store money at the clinic front work area inside 24 hours.

At the point when individuals face such situations, they take a personal loan. With fast turnaround time, applying for a personal loan and getting disbursement can occur inside the space of hours when it is a crisis. On account of alluring personal loan interest rates, the EMI will be affordable. Along these lines, your family’s medical services won’t ever be compromised.

Wedding purposes

Guardians put something aside for their girl’s marriage. Yet, with twofold digit swelling and different issues, at times the marriage expenses corpus isn’t satisfactory. For grooms, there is hardly any money saved particularly in case they are wedding at a generally more youthful age. With the expense of weddings today higher than 10 years prior, monetary assistance during marriage is guaranteed. The vast majority don’t request money help from loved ones. All things being equal, they take a personal loan.

Taking a lot of personal loan helps them in utilizing it for marriage expenses, honeymoon trips and for setting up their new residence. For borrowers who have a standard stream of pay, taking a personal loan for a wedding and reimbursing the debt from compensation bodes well.

Utilizing a credit card or taking a loan from a neighborhood moneylender is a costly recommendation. All things considered, apply for personal loan with a tenure of 5 years and gradually reimburse the loan at your comfort and accommodation.

What are the advantages you would have from Personal Loan In Kolkata?

while you can take other loan options, a borrower might consider the advantages of taking a personal loan. As I already mentioned earlier, borrowing money comes with a certain regulation, which varies from one bank to another. However, when it comes to a personal loan in Kolkata the process is much more user-friendly.

Easy Application

When you need a good amount of cash ad decided to lend the money from a bank, it takes a few days and sometimes weeks to get the final approval. However, in the case of a personal loan you have the convenience to avail of the loan on the same day.

Moreover, one simply needs to apply for the loan request online and wait for the cash to get debited to your bank account.

Quick Disbursal

First of all you need to submit a few documents to the lender. After the minimum documentation, you will get an instant personal loan in Kolkata with our quick turnaround time. Say goodbye to waiting for weeks for loan approval and get your personal loan sanctioned in just a few days.

Can it be more convenient when it comes to lending money?

Easy Eligibility Criteria

Just like every policy, everything in a metropolitan city like Kolkata comes with a prerequisite. You can name it as eligibility criteria. It has a criteria, you can find the entire section described below. We have easy eligibility criteria to ensure that everyone can avail a personal loan seamlessly. Check your eligibility using our quick and easy to use online eligibility calculator.

Multi-Purpose Personal Loan

There is no compulsion when it comes to using the lending money. Personal loan in Kolkata offers the flexibility to the users to use them for multipurpose. Get personal loans sanctioned for a variety of occasions, no questions asked. We provide personal loans for all your needs be it education, travel, marriage, or an unplanned emergency.

Collateral Free Loans

And, last but not the least, a Personal loan comes with the blessing of ‘no collateral’. You need to simply follow the eligibility criteria and the rest of the things will be taken care of by the lenders. No collateral or assets are required to avail of our instant personal loans, making it easier to apply and get the loan disbursed quickly.

Low Processing Fee

When you are applying for personal loans in Kolkata, Roopya compares various lenders for the lowest processing fee for you. There are no additional documents required for this.

Eligibility criteria of Personal Loan in Kolkata

The eligibility criteria vary from one bank to another. Just like the interest rate banks and other financial institutions have a different set of rules.

The following people are eligible to apply for a Personal Loan:

- Employees of private limited companies, employees from public sector undertakings, including central, state, and local bodies

- Individuals between 21 and 60 years of age

- Individuals who have had a job for at least 2 years, with a minimum of 1 year with the current employer

- Those who earn a minimum of 15,000 net income per month

Required Documents for Personal Loan in Kolkata

These are required documents that you will need to apply for a personal loan at Roopya. If you are self-employed with a high salary in hand, you can still submit the necessary documents with the application form to quickly approve the loan amount.

Income Proof

For verification of Income Proof, you will require the following documents-

- Recent Bank Account Statement

- Salary Slips of Past Recent Month

- Income Tax Return Copy of last six months

- PAN Card copy

Identity Proof

Read the following details to know about the important documents for the verification of your identity proof-

- Passport

- Adhaar Card

- Voter ID Card

- Driving License

Residence Proof

For residence proof, you need to submit the following documents listed below-

- Passport

- Ration Card

- Adhaar Card

- Utility Bills

Bottomline

This city, Kolkata has many famous lenders including banks and non-banking financial companies (NBFCs) that provide top-class personal loans at an affordable price. Moreover, you can choose a personal loan online or offline.

To apply online, you will need to visit your bank’s official website (the instruction is given in the previous section) or a third-party financial website. To apply offline, you will need to go to your lender’s branch and apply with the assistance of a branch executive.

If it sounds good to be true, please give us a call and clear your doubts. Or you can simply click here to request a query.

FAQs

The following lists of FAQs will help you to understand the policies better.

What will be tenure and downpayment, and interest rates for the personal loan program?

Choose our flexible repayment EMI options. We offer multiple benefits for a personal loan in Kolkata starting from comfortable downpayment and suitable tenure. Once we review the loan application form and endorsed documents, we will decide on a good deal for you.

How can I get an instant cash loan in 1 hour?

Getting an instant cash loan or personal loan in Kolkata is very simple if you meet the eligibility criteria. First of all, log in to our account with your basic personal information.

Provide necessary details and get your loan hassle-free: Instant cash loan

- Select your desired loan plan: Based on eligibility criteria, you need to choose the loan amount.

- Submit necessary documents: In the next step, you need to submit all the documents required for the process.

- Instant cash loan request: find the loan disbursal tenure and submit the proposal. The loan amount will be credited to your account within 24 hours.

P.S: If you are self-employed or work in a multinational company, or a government employee you need to give your salary proof (with bank account details) to avail the best personal loans in Kolkata.

How do I get a mini cash loan?

A mini cash loan is taken for a short tenure. If you need a small amount personal loan immediately, you can request your proposal just by clicking the link here. Submit all the documents required for a personal loan in Kolkata and get your approval instantly.

How can I get a 5000 RS loan?

If you are 21 years of age or above, you can request 5000 rs. Instant personal loan. In order to request the loan process, please check on the eligibility criteria.

How can I instantly borrow money?

You need to submit identity proof (voter card, pan card, Aadhar card), address proof last three months of salary slips to borrow money instantly. It will hardly take 24 hours to credit your loan amount if you meet all the prerequisites.

How can I get a loan in Kolkata?

If you are in financial emergencies and want to apply for a personal loan in Kolkata, you can follow the simple steps:

- Request for a personal loan

- Choose a loan program

- Submit your identity proof and address proof

Once it gets approved, the money will be credited to your bank account

Which bank provides easy loans?

From Tata capital, RBL bank to HDFC, you have different banks options to choose from. If you follow the general guidelines and meet the eligibility criteria, you will get an instant cash loan for a short and long tenure.

Which bank has the easiest personal loan approval?

At Roopya, you will get the easiest personal loan program process. Moreover, this company offers huge advantages for their account holder.

How much loan can I get if my salary is 20000?

The maximum loan approval rate is up to 5.40 Lakhs if your monthly income is 20,000. However, the amount of loan may differ from one company to another. Any financial institution follows a strict guideline to approve the personal loan amount. You can check our separate eligibility criteria for a hassle-free process.

How can I get a 100000 loan?

If you are 21 years of age or above, you can request Rs. 1 lakh. Instant personal loans. In order to request the loan process, you have to select your employment type and submit the required documents.

Apply now: Rs. 1 lakh personal loan

Where can I find someone to lend me money?

When it comes to lending money, it is always better to go for a trusted company. A credible organization will always assist customers like you with the lowest interest rates. Lenders demand a few documents ants before they pay the funds.

21,897

Leave a Comment

Your email address will not be published. Required fields are marked *