Instant cash loan in 1 hour is a sigh of relief for those who have been affected by the slow process of getting a conventional bank loan. It’s not only faster than any other type of loan but also you don’t need to provide any collateral or a pile of documents.

Instant cash loan in 1 hour is a sigh of relief for those who have been affected by the slow process of getting a conventional bank loan. It’s not only faster than any other type of loan but also you don’t need to provide any collateral or a pile of documents.

Any salaried or self-employed person can avail of this loan through several Financial Institutions. You can get an Instant Loan for an amount ranging from ₹5000 -₹2,00,000, or more according to the Financial Institution of your choice.

Apply now to get a personal loan in 1 hour. Click here.

Table of Contents:

Instant Cash Loan in 1 Hour – Features

Eligibility Criteria for Instant Cash Loans in 1 Hour

Documents Required for Instant Cash Loans in 1 Hour

How to Apply for Instant Cash Loans in 1 Hour?

FAQs

- How to get an instant cash loan?

- How much time it will take to complete the application process?

- Where to apply to get an instant cash loan?

- Can I get a loan on the same day?

- What is the easiest loan to get approved for?

- How can I get an instant loan in 5 minutes?

Instant Cash Loan in 1 Hour – Features

Hassle-Free Digital Processing for Loan Application

The whole process is conducted online. You don’t need to go to any office or kiosk as long as you meet all the criteria. Submit all the documents asked for on the website, and the lender will grant you the loan at the earliest.

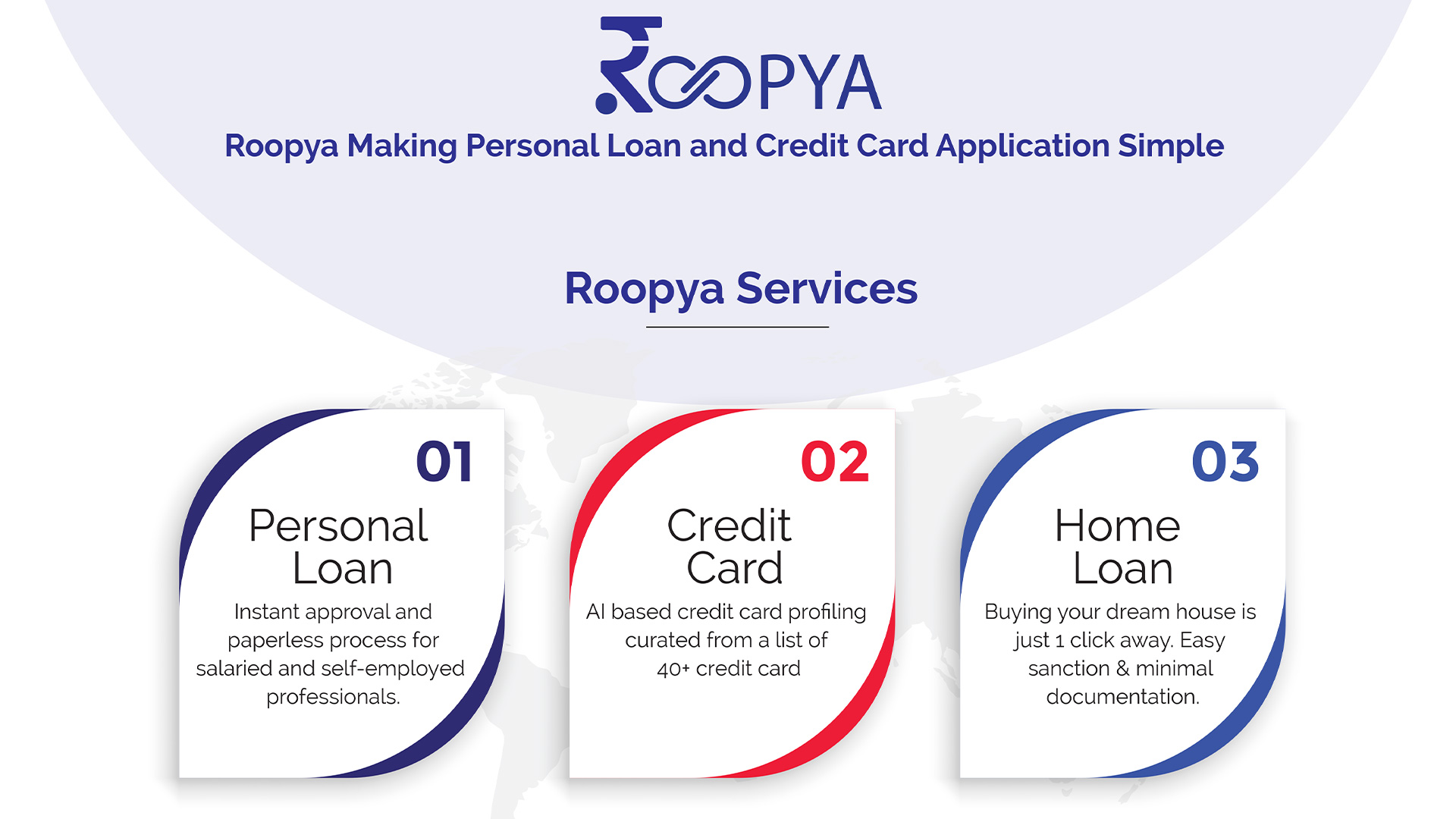

Roopya.com makes the process even easier for you. We compare different options from our partners and provide you the loan on the best terms possible.

Interest Rates for Instant Cash Loan

Unlike banks, the interest rate is far more lucrative here. You’ll be charged with an average interest rate of 1.50% and 2.25% p.m. It varies from company to company, on whether you’ll get a lower interest. It also depends on your credit score.

At Roopya, we make sure that our customer is getting the best interest rate by connecting them with the best companies. Compare personal loan interest rates.

Credit Score Required for Cash Loans

The credit score is a high-value component in instant cash loans. If your score is more than 650, you’ll be comfortable getting loans from any company. But if you’re a fresh employee and don’t have anything to show in credit scores, or have extremely low credit scores and you are applying through Roopya, you may get some relaxation as we do not give high impetus whether you got a scope to build up your credit score.

Read our full blog on: Credit score in India

Tenure

Tenure is open-ended in instant cash loans. Depending on your loan amount, you can choose some month to even a 5-year long tenure. Although various companies have different minimum and maximum tenure period, the average is the same. But rest assured, you will get a good scope to choose the tenure you want to pay along as Roopya provides you with a good number of options to choose from depending on your requirement.

Eligibility Criteria for Instant Cash Loans in 1 Hour

Age

The minimum age to get an instant cash loan in 1 hour is anywhere from 18 to 23 which varies from company to company.

Minimum Required Income

The Minimum Required Income varies depending on the area of your residence and credit score. The Delhi NCR region and Mumbai require the maximum amount to apply for such loans. But Roopya allows you to take an instant loan even if your monthly salary is ₹12,000 per month.

People who are self-employed have Minimum required Income criteria of ₹25,000in-hand income every month and s/he must be at least 25 years.

Authentic Documents

Roopya asks for minimum yet vital documents for the approval of your instant loan application. All the documents you upload should be 100% correct and up to date. If the company finds any sort of inconsistencies or forgery, your application will be rejected. So, be extra careful with the documents you submit.

Minimum Employment Period

Although it’s not mandatory, some companies require their borrower to be employed for more than 6 months. So, anyone with an employment record of more than 6 months can apply for an instant cash loan. However, Roopya can help you to find the most compatible instant loan lender for you.

Documents Required for Instant Cash Loan in 1 Hour

- Any sort of Identity Proof (Aadhaar / Driving License / Passport / Voter ID)

- PAN card

- Address Proof (Driving License / Utility Bills / Aadhaar / Passport / Bank Statements / Voter ID)

- Bank statement for the last 3 months

- Last 3 months’ payslips/ salary slips.

- Company ID card copy (for Salaried person)

- Standard Passport Photo with a clearly visible face

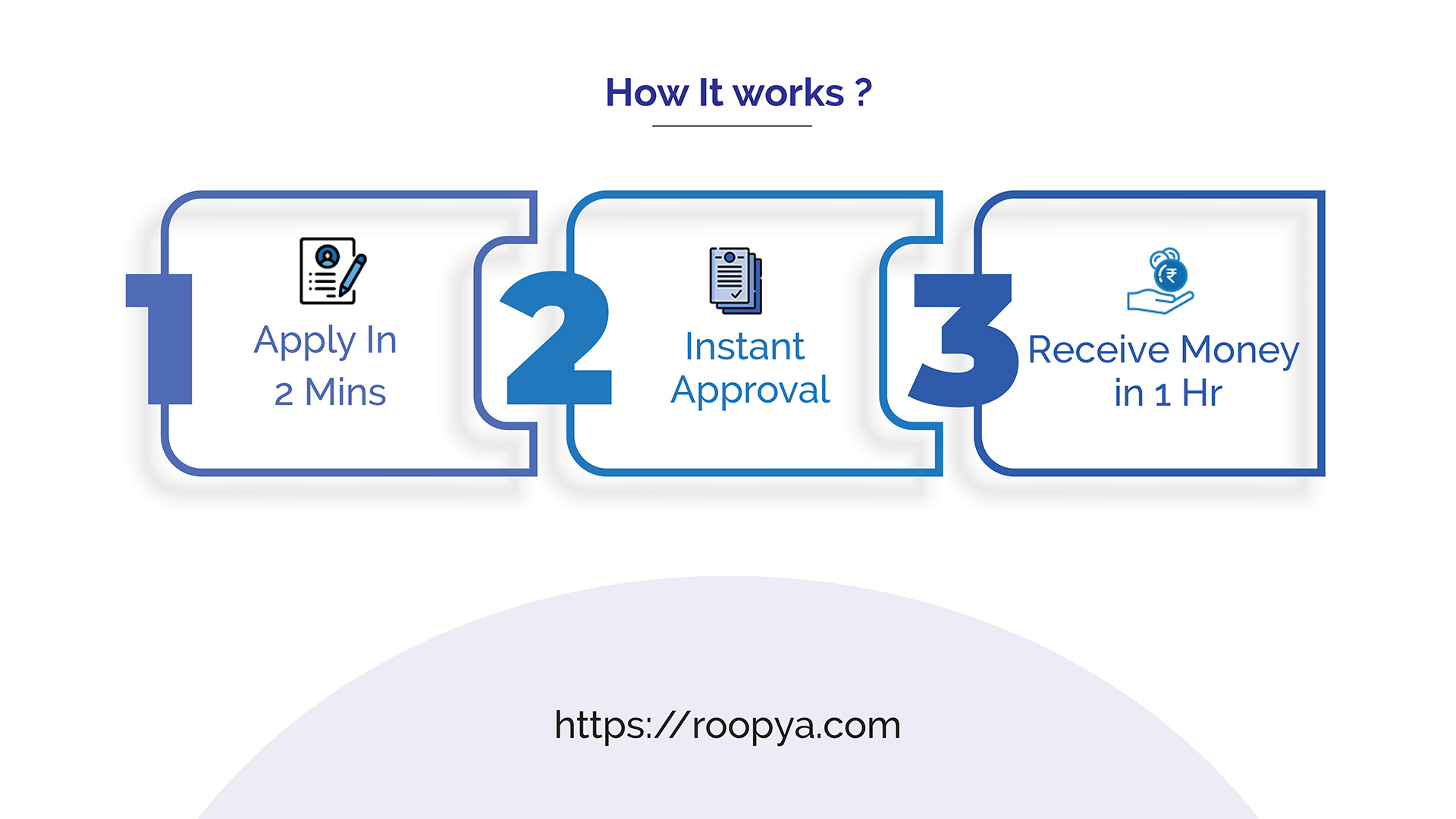

How to Apply for Instant Cash Loan in 1 Hour?

Step 1

Our website will prompt you to fill in some personal details,

- Employment status (Salaried/ Self-employed)

- Monthly in-hand salary

- Loan Purpose

- Gender of the Applicant

- Full Name as per PAN Card

- Date of Birth

- Local PIN Code

- PAN Number

- Mobile Number

Once your account is created, the company will let you know the amount of loan you’re eligible for.

Step 2

It’s time to choose the loan plan you need. The company will offer you multiple plans of different amounts, tenures, and interest rates. Select the one that fulfills your purpose in the best way.

Step 3

Here you’ll be asked to submit the documents mentioned above. Make sure the scanned copies of the photographs are clearly visible and no information is left out. Now, your lender will take some time to verify and crosscheck the documents you submitted.

Once the verification is complete, and no errors are seen, Roopya’s partner company will disburse the loan amount instantly in your bank account. There you go, your instant loan amount in your account ready to be utilized.

Looking for specific bank? SBI Personal Loan | Ujjivan Small Finance Personal Loan| Shubh Personal Loan

FAQs

How to get an instant cash loan? /How can I get money urgently?

The best way to get an instant personal loan is to apply to Roopya.com. We offer instant cash loan in 1 hour by providing you with the best loan options. You’ll get the money within the same day in your account without any hassle and even leaving the house.

How Much Time it will take to complete the loan application process?

The application process for an Instant Cash Loan takes hardly 10 minutes on Roopya’s website. All you need to do, is create an account with your personal details, fill out the application with the required documents, and it’s done.

Where to apply to get an instant cash loan?

Roopya.com offers instant cash loans with different features from all sorts of companies. You can select one from them according to your requirements. The amount, tenure, interest rates or criteria, of them, varies so make sure to analyze the companies accurately.

Can I get a loan on the same day?

Yes. If you apply for an Instant Cash Loan in 1 Hour on Roopya, you can get a same-day loan without any troubles.

What is the easiest loan to get approved for?

The easiest loan to get approved for is the Instant Cash Loan in 1 Hour from Roopya.com. Roopya doesn’t ask for any collateral, so if you meet the minimum criteria of the loan, you’ll be selected.

How can I get an instant loan in 5 minutes?

The process is quite simple. Log in to the Roopya.com website and fill out your personal details. Then you’ll be given multiple loan options to choose from. After you choose the best plan for you, you’ll need to upload all the required documents. After that, it’s only a matter of time before a loan expert verifies your documents and grants you the loan.

How can I get a small cash loan instantly?

Getting a small instant cash loan in 1 hour in India is now made easy by us. For an instant cash loan in India, you can apply for an instant loan in just 2 mins on our portal. You do not have to worry about the minimum credit score for a personal loan of this small.

Bottom line

An instant loan that you can get access to within 1 hour, surely makes a difference during your financial urgency. Let us know if you have any financial needs that we can assist you to overcome. We will be happy to see you maintaining a smooth and hassle-free lifestyle.

68,450

Leave a Comment

Your email address will not be published. Required fields are marked *