Instant IndusInd Bank Personal Loan

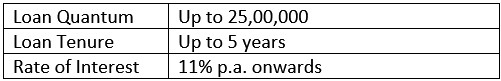

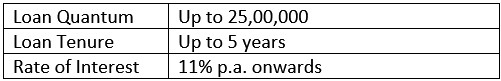

With an interest rate starting from 11%, you can quickly get an accessible fund of up to 25lakh if you apply for an instant IndusInd Bank personal loan online. And with the processing fee of up to 3% on the loan quantum, one can get up to 5 years of tenure for the repayment. Apply Instant Personal Loan

Overview of instant IndusInd Bank personal loan

- The easy application process to apply for IndusInd personal loan online

- Bank will complete the KYC over a video call

- Zero requirements of collateral and guarantor while you apply for instant IndusInd Bank personal loan online

- Avail of pre-qualified loan offers without any compulsory income proof

- Balance transfer facility reduces your burden

- A top-up loan is also available after you apply for IndusInd personal loan online

- A pre-closure option is also available @ 4% fee

- The bank has 754+ branches at your service

- Easy eligibility criteria with least physical documentation to apply for IndusInd personal loan online

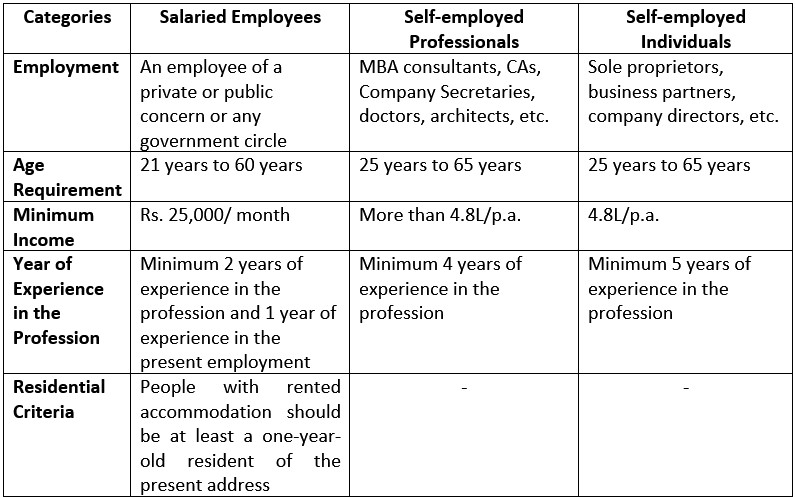

Criteria to apply for instant IndusInd Bank personal loan

Depending on the monthly income of the borrower, the IndusInd bank personal loan has the following basic criteria.

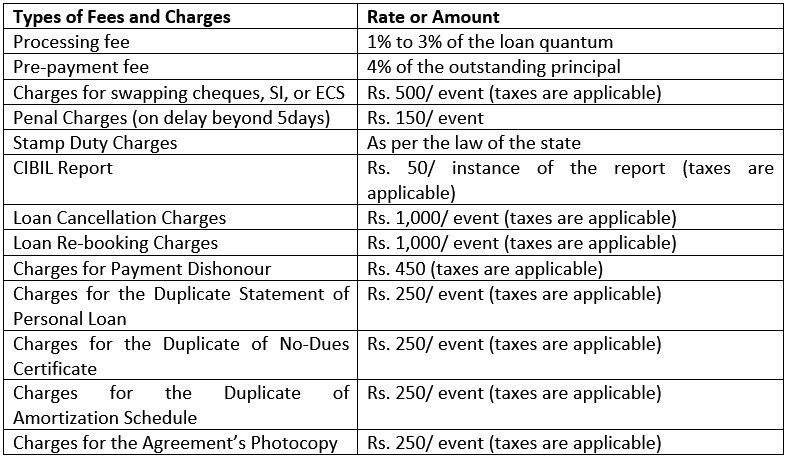

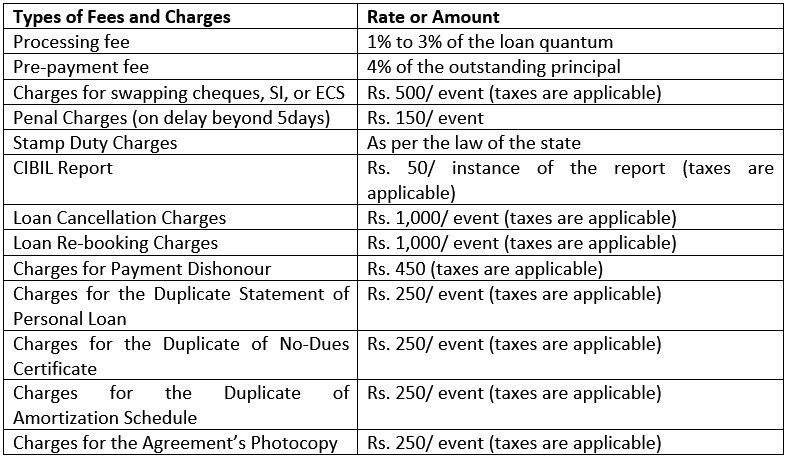

Fees and Charges of instant IndusInd Bank personal loan

Apart from the interest, to apply for IndusInd personal loan online you should know the following fees and charges.

Features of instant IndusInd Bank personal loan

IndusInd Bank personal loan has multiple features that make the loan approachable and useful to tackle any financial need.

- Borrowers get a flexible tenure of up to 5 years to repay the loan in easy EMIs.

- Interest rates are quite competitive.

- Borrowers don’t need to produce any collateral or guarantor for approval once they apply for an IndusInd personal loan online.

- The least physical contact will require for the application due to the online application process, doorstep service, and disbursal to the bank account.

- Borrowers can also repay the loan through ECS directly from their IndusInd Bank account.

- The balance transfer facility helps to reduce the burden of your existing loans.

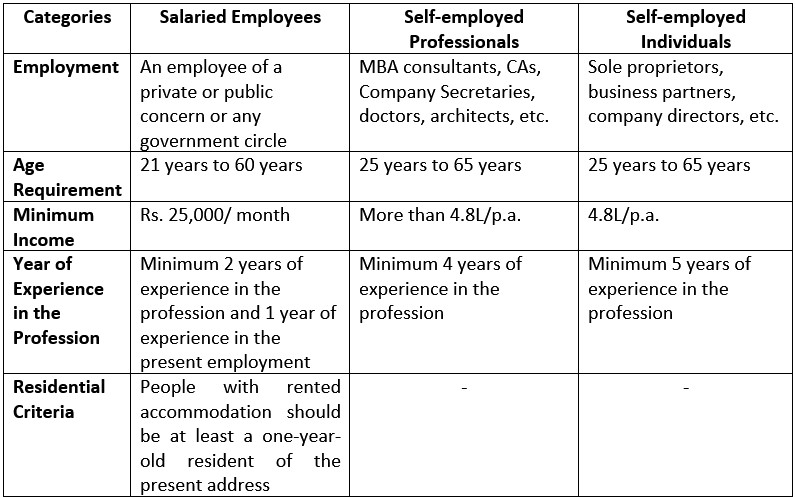

Eligibility for instant IndusInd Bank personal loan

As per the eligibility criteria, three different categories of borrowers can apply for IndusInd personal loans online.

Documents required for instant IndusInd Bank personal loan

- Copy of borrower’s identity and address proofs such as Voter’s ID card, Aadhaar card, driving license, passport, etc are mandatory before you apply for IndusInd personal loan online

- Current salary slips

- Salary certificate, along with Form 16.

- Bank statements.

- Recent ITR or Form 16.

- Photographs to attach to the signed application form.

What Is IndusInd Bank Personal Loan Balance Transfer?

The IndusInd Bank balance transfer facility is made for people who are repaying personal loans with high interest. IndusInd Bank balance transfer allows a borrower to transfer the existing personal loan to the bank and get a lower rate of interest due to competitive rates. Thus the borrower can repay the loan on time more conveniently and maintain a good credit score to further apply for IndusInd personal loan online.

How to apply for instant IndusInd Bank personal loan online through Roopya

Applying for the IndusInd Bank personal loan through Roopya is quite simple and hassle-free.

- Visit the official website of Roopya.

- Put the basic information about yourself such as name, age, income, etc.

- Then our website will direct you to the IndusInd Bank personal loan’s page to select the loan quantum and tenure.

- Our EMI calculator will assist you to calculate the estimated EMIs even before you apply for IndusInd personal loan online

- You can compare the loan offers also.

- And after the online application procedure, a representative on behalf of the bank will contact you and complete the final application procedure such as signing the form, collecting the documents, etc. (811 words till here)

Know more about: Instant Cash Loan in 1 Hour

Calculate your EMI before you apply for instant IndusInd Bank personal loan

With the help of Roopya’s EMI calculator, borrowers can calculate the estimated EMIs on IndusInd Bank’s personal loan.

- Go to Roopya‘s official website and select the IndusInd Bank personal loan.

- Now put the essential information such as loan quantum, tenure, rate of interest, and processing fees.

- Then click on the ‘Calculate’ button to find the EMI.

IndusInd Bank Personal Loans FAQs

-

What is the way to repay my amount once I apply instant IndusInd Bank personal loan online?

Borrowers have to repay the IndusInd Bank personal loan in Equated Monthly installments, which they can pay through ECS or ask their bank to debit the EMI amount from their bank account.

-

Where can I get the application form online?

One can either download the application form for IndusInd Bank personal loan from the bank’s official website or can go to Roopya’s official website to fill up the online application form.

-

How long I’ve to wait for approval after I apply for instant IndusInd Bank loan online?

It will take 4 to 7 working days for the bank to approve the IndusInd Bank Personal loan.

-

What is the maximum quantum for IndusInd Bank’s personal loan?

IndusInd Bank personal loan offers a quantum ranging from Rs. 50,000 to Rs. 25,00,000 depending on the eligibility criteria such as income, age, credit score, credit history, etc.

-

Do I need to be an IndusInd Bank account holder to apply for instant IndusInd Bank personal loan?

No, you don’t have to be an IndusInd Bank account holder to apply for a personal loan.

-

Do the IndusInd customers get any privilege?

An IndusInd Bank customer will get privileges such as customized loan offers, interest rates, quick loan processing, etc. as the bank gets to know your income and savings pattern to offer such comfortable facilities.

-

What is the procedure for the pre-closure of the loan once I have applied for instant IndusInd Bank personal loan online?

A salaried borrower and a self-employed borrower can avail of the pre-closure option after paying the first 12 EMIs and the first 6 EMIs, respectively. After that, they can repay the outstanding amount at once by paying 4% pre-closure fees on the outstanding principal.

-

How can I check the status of my IndusInd personal loan?

There are three different ways through which one can check his or her IndusInd personal loan status.

Log in to the official website of the IndusInd Bank using the net banking details.

Contact the customer care representatives or go to the IndusInd Bank branch, nearest to your location.

Visit the official website of Roopya, as our website will navigate you to the bank’s personal loan page.

-

How to check my IndusInd Bank personal loan statement online?

Borrowers can access the IndusInd Bank personal loan statement by logging into their loan or bank account. Or they can send a request for the statement by email or calling the customer care representative.

-

What is the procedure to contact the customer care of IndusInd Bank?

To contact customer care of IndusInd Bank, a borrower can

Call at 1860 500 5004/ 022 44066666 anytime.

Send an Email at reachus@indusind.com

Go to the nearest branch of the IndusInd Bank.