Instant HDFC Bank Personal Loan

With an interest rate starting from 10.75% p.a., the HDFC personal loan gives you a flexible tenure of up to 5 years. You can apply instant HDFC personal loan online and avail of the loan amount of up to Rs. 15 lakh with processing fees of up to 2.5% on the loan quantum.

Overview

Benefits of applying instant HDFC personal loan online

- Zero-requirement of collateral and guarantor

- Easy online application and approval

- Simple Eligibility Criteria to apply HDFC personal loan online

- The sales team provide service at your doorsteps

Know more about: Cash Loan in 1 hour

Conditional pre-closure and part-payment options once you apply instant HDFC personal loan online

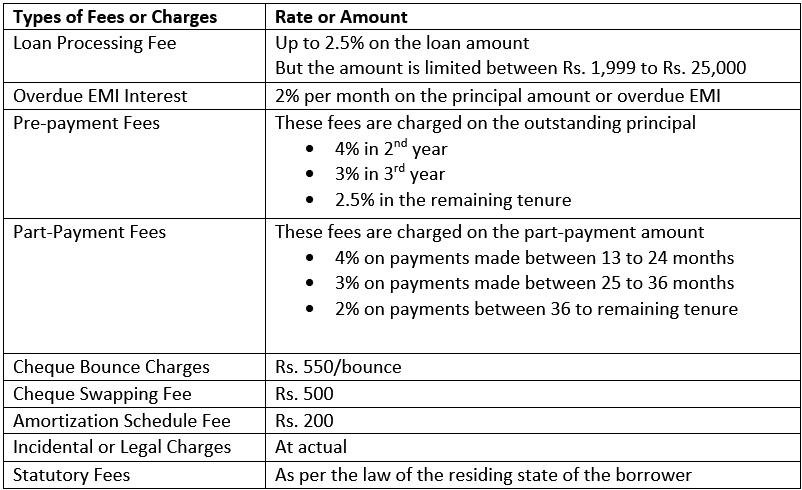

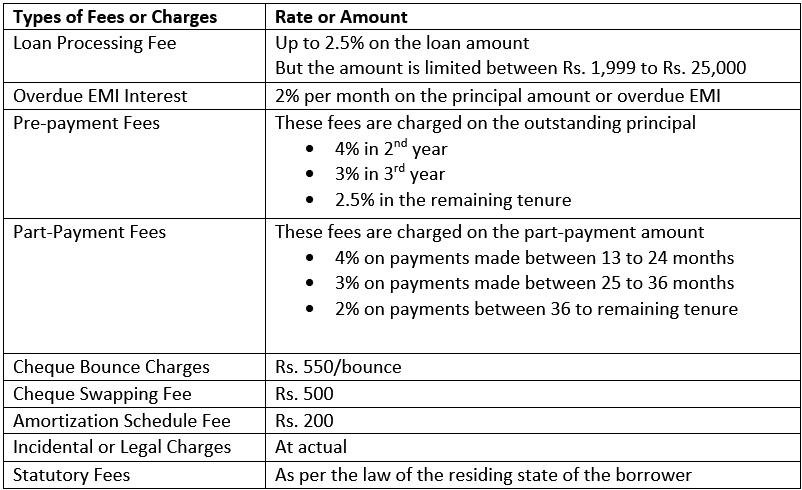

- Borrowers once they apply HDFC personal loan online get a pre-closure option after the first year of the tenure. Then the bank charges pre-closure fees on the outstanding principal @4% in the 2nd year, @3% in the 3rd year, and 2.5% for the remaining tenure.

- After the first 12 months of the tenure, part-payments can be done. Borrowers have to pay 4%, 3%, and 2% fees on the part payment made between 13 to 24 months, 25 to 36 months, and 36 months to the remaining tenure, respectively.

- The conditional part-payment can be made only twice in tenure and once a year once you have applied for an instant HDFC personal loan online. And the pre-payment amount is limited to 25% of the outstanding principal.

Criteria for instant HDFC personal loan online

HDFC personal loan quantum, tenure, and interest rates will depend on the income of the borrower. But the following loan criteria can provide you an overview of the loan criteria before you apply HDFC personal loan online.

| Available Loan Quantum |

Rs. 50,000 to Rs. 15,00,000 |

| Available Tenure |

Up to 5 years |

| Rate of Interest |

10.75% to 21.30% per annum |

Click here to know about: Personal Loan Amount

Features of HDFC personal loan

The features are quite simple if you apply instant HDFC personal loan online.

- If you apply HDFC personal loan online, you should know that it is collateral-free and doesn’t ask for any guarantor.

- You will get quick access to the fund as the bank disburses the loan amount on the same day.

- Borrowers can also avail of the “Sarv Suraksha Pro” policy and an optional insurance cover to get accidental cover, illness cover, disability cover, etc.

Fees And Charges to know

The bank can charge the following fees and charges from the borrowers who have applied for HDFC personal loan online.

Eligibility Criteria for applying instant HDFC personal loan online

- You should be at least 21 years old, and the age limit is up to 60 years to apply HDFC personal loan online.

- HDFC account holders with Rs. 25,000 salary per month can apply for HDFC personal loans. Others must have a monthly income of Rs. 50,000.

- The borrower should be an employee of a private company, public sector, or a government body.

- The borrower should have 2 years of work experience and should be employed in the current company for at least 1 year to apply HDFC personal loan online

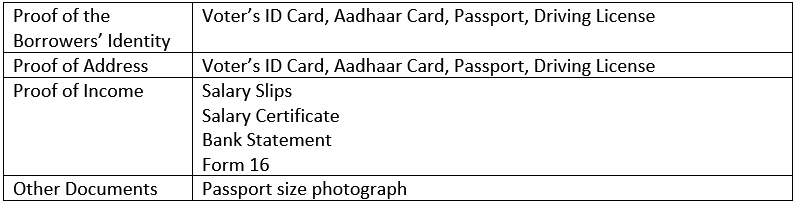

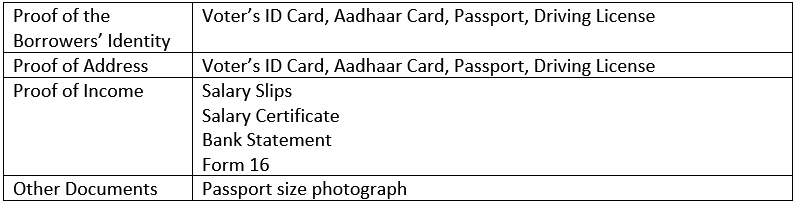

Documents required to apply instant HDFC personal loan online

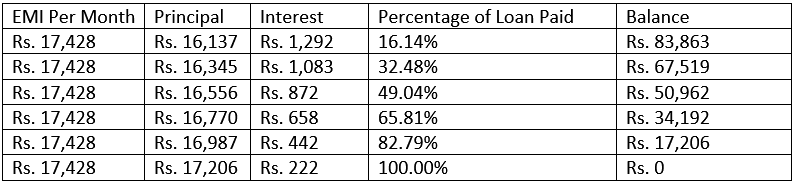

Calculate Your EMI before applying instant HDFC personal loan online

Calculating the EMIs of the HDFC personal loans is quite simple on Roopya’s official website. You have to put the required loan amount, tenure, and interest rate and click on the “Calculate” button to find the EMI.

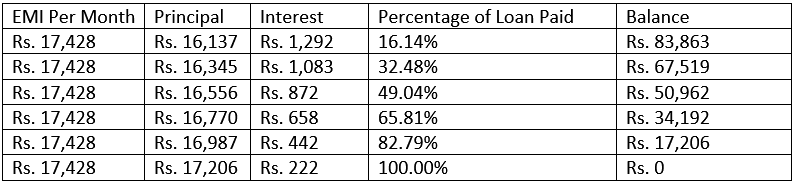

For example, if a borrower apply HDFC personal loan online worth Rs. 1lakh from @ 15.5% interest rate per annum, then the EMI calculation will be as follows.

To calculate your EMI, check: EMI Calculator

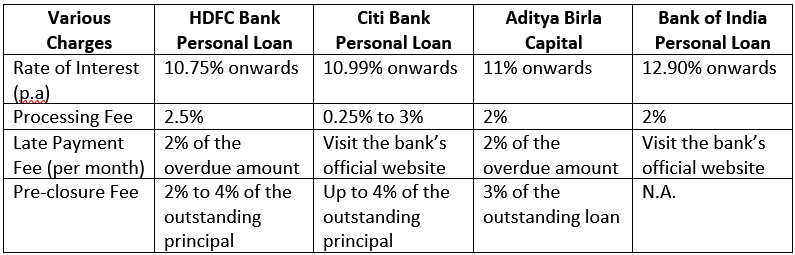

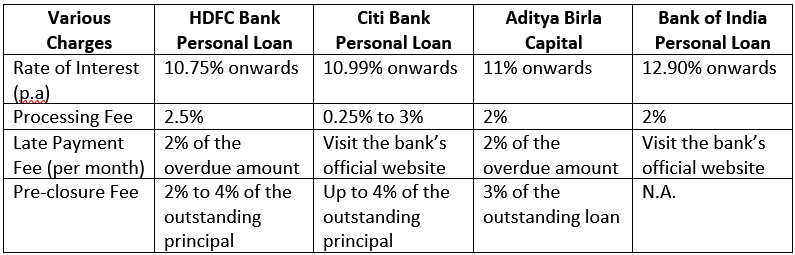

Comparison with Other Lenders once you apply instant HDFC personal loan online

FAQs about HDFC Personal Loan

-

What are the ways to repay the amount once borrowers apply HDFC personal loan online?

Borrowers have to repay the loan in EMIs that they can pay via ECS or post-dated cheques. Or they can debit the EMI amount from their HDFC bank accounts.

-

Are business owners eligible to get instant HDFC personal loan online?

No, only salaried persons are eligible for HDFC personal loan.

-

Does HDFC bank personal loan charge floating rates of interest?

No, HDFC personal loans only charge fixed rates of interest.

-

What is the available tenure for HDFC bank personal loan?

Borrowers can get tenure of up to 5 years for HDFC bank personal loan.

-

Does HDFC personal loan allow conditional part-payment?

If you have taken HDFC personal loan after 1 April 2018, then you can avail of the conditional part-payment option after paying the first 12 EMIs.

-

What are the conditions for part-payment of HDFC personal loan?

Within a loan tenure, a borrower can make part-payments twice.

In a year, the borrower can make part-payment once.

The part-payment amount exceeding 25% of the outstanding principal is not allowed.

The part-payments fees should be paid for the payment.

-

What is the way to check the status of my HDFC personal loan?

You have to visit the official website of HDFC bank and put the proposal or reference number of the loan and your phone number to check its status.

-

What makes a borrower eligible for the HDFC personal loan moratorium?

As per the RBI guidelines, if a borrower has taken a personal loan before 1 March 2020, then he or she is eligible for the HDFC personal loan moratorium. However, whether a borrower having overdue before 1 June 2020 will get the moratorium facility or not solely depends on the HDFC bank.

-

What are the contact numbers of HDFC personal loan customer care?

A borrower can dial the following numbers between 8 a.m. to 8 p.m. and reach out to a customer care executive for any queries about how to get instant HDFC personal loan. Avoid calling on Sundays and bank holidays. Visit their page for more details.

- Delhi and NCR: 011 – 61606161

- Mumbai: 022 – 61606161

- Pune: 020 – 6160 6161

- Kolkata: 0522 – 6160616

- Bangalore: 080 – 61606161

- Hyderabad: 040 – 61606161

- Chennai: 044 – 61606161

- Ahmedabad: 079 – 61606161

- Cochin: 0484 – 6160616

- Indore: 0141 – 6160616

- Chandigarh: 0172 – 61606161

- Jaipur:033 – 61606161