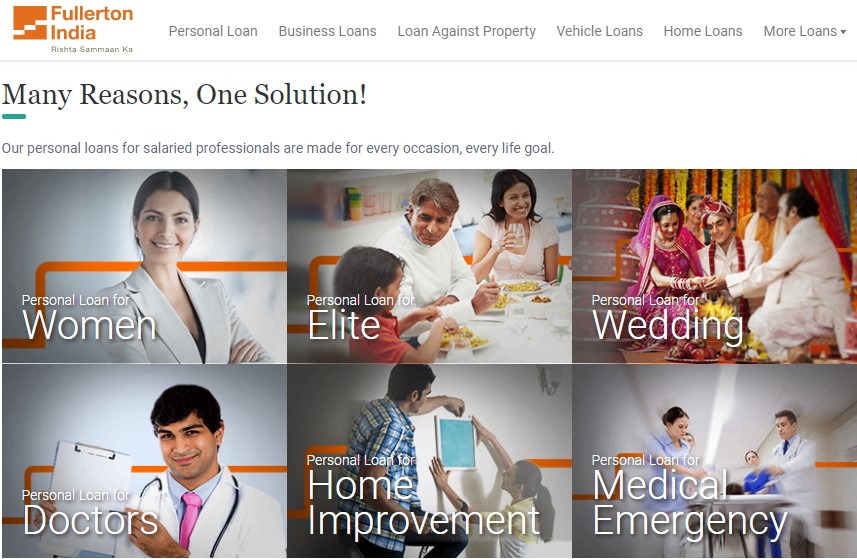

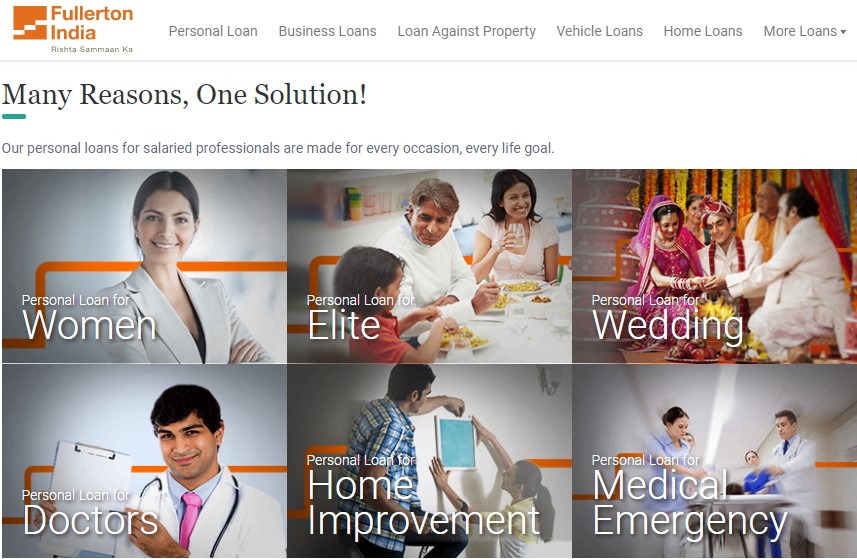

Instant Fullerton India Personal Loan

A Brief Overview to apply instantly for Fullerton India personal loan online

• No guarantor is required to apply.

• Collateral-free in nature.

• Conditional foreclosure is available after the successful payment of the first 6 EMIs.

• Salaried and self-employed, both can apply for instant Fullerton India Personal Loan online.

• Availability of doorstep service.

Criteria To Apply Instantly For Fullerton India Personal Loan

Available Loan Quantum: Rs. 50,000 to Rs. 25,00,000

Available Tenure: 1 year to 5 years

Rate of Interest (Monthly Reducing Balance): 11.99% to 36% per year

Processing Fees (One Time): Up to 6% of the loan quantum

The maximum loan quantum available for women is Rs. 10,00,000.

Features of Applying for Fullerton India Personal Loan

• As the highest amount available is Rs. 25 lakh, one can easily apply for an instant Fullerton India personal loan online to meet big expenses such as higher education, funding a start-up, traveling the world, wedding, etc.

• Flexible tenure of up to 5 years gives the ease of repayment to the borrowers.

• You get an affordable rate of interest also.

• You can easily apply for Fullerton India Personal Loan online and get an e-approval of your application with proper documentation.

• Conditional foreclosure facility provides the freedom of remitting the loan before time to the borrowers.

• Besides, Fullerton India has a 24/7 customer service helpline to assist you in any loan-related issues.

Eligibility Criteria to Apply For Instant Fullerton India Personal Loan

Age Requirements: Minimum 21 Years

Maximum 60 years

Income Requirements Salaried person: Rs. 25,000 (for Mumbai and Delhi residents)

Rs. 20,000 (for the residents of other Indian cities)

Self-employed: as per the current policy

Minimum Work Experience: 1 year

Age of Employment: in the Present Company 6 months

Credit Score: 750 and above

Total EMI Obligation: Should not be more than 65% of the monthly income

Documents Required To Apply for Fullerton India Personal Loan

You need to produce the following documents to apply for Fullerton India Personal Loan Online.

• KYC Document- Voter’s ID card/ Aadhaar Card/ Driving License

• Last 6 months’ bank statements (salary/ current account)

• Salary slips of last 3 months

• Other income proofs (self-employed individual)

The Credit Information Report

Unlike other personal loan lenders, Fullerton India offers the facility to its borrowers to check the credit information report such as credit score, credit history, loans, payments, etc. Just follow the following steps.

• Visit the website of Fullerton India and click on “Credit Information Report Online”.

• After that, put the loan account number and registered mobile number in the pop-up window and click on “Submit”.

• You will get the report on your registered email ID.

How To Apply Fullerton India Loan Through Roopya

Roopya is the most convenient and efficient platform to apply for Fullerton India Personal Loan Online. Here you get the EMI calculator, where you’ve to put some basic information and the system will show you the most suitable loan offers for you and you can also compare the offers there.

• To apply for Instant Fullerton India Personal Loan Online, Visit Roopya’s website and put the basic information like name, age, income, loan amount, tenure, etc.

• Then the system will show you the loan offers and you have to select Fullerton India as your lender.

• Now upload the soft copies of the required documents and get instant approval of your loan application.

• The lender will contact you to collect the documents from you and your loan will be disbursed with the completion of the application.

Read more about: Instant cash loan

FAQs

What is the maximum loan amount I can get from Fullerton India?

Depending on your eligibility, you can get a personal loan of up to Rs. 25 lakh from Fullerton India.

How would I know that I’m eligible for Fullerton India Personal Loan?

Both the salaried and the self-employed individual is eligible to apply for Instant Fullerton India Personal Loan Online with a minimum monthly income of Rs. 25,000 or Rs. 20,000, depending on your city. And your age should be in between 21 years and 60 years.

What are the ways to repay my Fullerton India Personal Loan?

You can pay the EMIs through cheque deposits or via an online fund transfer facility.

Do I have to pay charges for using the EMI calculator of Roopya?

No, checking your EMI using the EMI calculator is free of cost on Roopya’s official website.

Calculate using our EMI Calculator.

Is it safe to use Roopya while applying for Instant Fullerton India Personal Loan Online?

All the data that you share with Roopya is fully encrypted and not shared with any third party. Only the lender will get to know the required information to process the loan effectively.

What is the foreclosure procedure?

Fullerton India Personal Loan has the conditional foreclosure option where you can remit the loan after the payment of the first 6 EMIs. The facility is chargeable (0% to 7% on the outstanding principal) and you can foreclose the Fullerton India Personal Loan account by issuing a cheque.

What are the ways to check my Fullerton India Personal Loan status?

There are three ways to check the loan status.

1. Give a missed call at 9594763763 to connect with the customer care executive of Fullerton India.

2. You can send an email to namaste@fullertonIndia.com

3. Download the mConnect app and login there.

What is the customer care number of Fullerton India?

1800 103 6001 is the customer care number of Fullerton India and you can call the number between 9 a.m. to 7 p.m except for weekly offs and public holidays. Fullerton India provides personal loans ranging up to Rs. 25 lakh at a convenient rate of interest starting from 11.99% p.a. for up to 5 years. The loan is collateral-free and has a conditional foreclosure facility.