Payday loan is a short-term loan to manage your month-end expenses. Apply for 100% paperless payday loan with Roopya & get the loan amount directly to your bank account.

Financial emergencies can knock at your door without any notice and put you in difficult circumstances. It may create more difficult situations if it comes at the end of the month. Payday loan can solve this problem for you.

To get a quick payday loan from Roopya, you don’t need any paperwork. Read more to know the role of payday loans in India.

How to Apply for Payday Loan?

Get instant payday loan from Roopya in just 5 mins. Applying payday loan is now really easy. Follow these steps to get a payday loan:

- Visit Payday loan Application: Loan application form

- Fill all the details step by step

- Get instant payday loan approval

- Receive your payday loan amount to your account

Why do you need a payday loan?

Payday loan is considered a high-cost unsecured loan. One can avail of payday loan both offline and online when he or she faces a short-term financial crisis. Typically, you have to repay a payday loan on your next payday.

An employed professional, sometimes, may experience urgent credit requirements if he has exhausted his salary already. Here, he can take the help of payday loans in India. He can utilize this payday loan for paying regular bills off, financing another spending of household, or addressing other short-term requisites.

So, how costly payday loans are?

Generally, a payday loan bears a high rate of interest. Still, payday loans in India are increasing their popularity at a breakneck speed with no need for any guarantor or collateral. Moreover, a person can avail of a payday loan even if he has a missing credit profile or a bad credit score. You can take a personal loan like payday loan alternatives.

In short, payday loans can act as a magic potion for you if you live month to month. If you face difficulty while gratifying sudden spending. Here are some major advantages of these loans that make them more famous among people.

Easy and quick

As these are instant cash loans, these can be approved as well as provided within a few minutes. You may confront no hassle or any lengthy waits.

Scanty formalities and documentation

The key requirement to get this loan is to have a bank account in cases mostly. You need to share some limited personal and financial details with payday loan services. Unlike other loans, you do not need a range of documentation.

No credit check

Often, the working poor avail these payday loans. Thus, no collaterals or credit checks are elicited. These loans can be availed by anyone notwithstanding financial background.

Eligibility Criteria for Payday Loans

There are some apps for payday loans in India that do not instruct ant strict eligibility norms. You have to meet some standard requisites to get these loans. The list of criteria is stated below:

- The borrower should be a citizen of India.

- He or she should be at the age of 18 years and above.

- Furthermore, he or she needs to be a full-time employee who earns a monthly salary.

- His or her monthly income should satisfy the criteria of the lending institution.

- Besides, payday loan borrowers need to have active bank savings account.

- The applicant needs to have all the needed documents for applying for this loan

- He or she should have an active phone number.

Documents Required for Payday loans

Also, a successful payday loan application necessitates the submission of some vital documents. They are:

- Identity proof such as Aadhaar card, PAN card, Voters ID, Driving License, Passport, and others related to this.

- Age proof

- Proof of income

- Residential proof such as Utility bills, Ration card, Driving License, Voters ID, Passport. Aadhaar card, and many more.

- Letter from the end of present employer

- Passport-sized photographs.

How Does A Payday Loan Work?

You may have an urgent requirement of money to pay some uninvited expense that’s not huge in quantum, but you still need help to cover it up. Payday loans are appropriate to tackle those situations and stand by your side. For example, you need Rs. 20,000, to fix or replace your laptop, but your payday is five days away. Now, this emergency can’t wait as you are working from home and need the laptop to finish your tasks. Hence, a payday loan can be your savior. You can take an instant personal loan amounting to Rs. 20,000 only for five days @ 1% interest per day. So you will repay-

Principle + Total Interest @ 1%/Day = Rs.{20,000+(20,000×1%x5)}

= Rs.{20,000+1,000}

= Rs.21,000

In this case, you may borrow the amount for five days or more, you need to pay the interest accordingly, and the lender would charge late fees and penalties in addition to that interest for the delays in the repayment.

Payday Loan Process

You must approach a lender who proffers relevant services for accessing a payday loan. It is to be stated that you won’t get any immediate loan services from banks as well as NBFCs as of yet.

Usually, the process revolves around the lender from whom the borrower gets an unsecured or personal loan. The person needs to repay the loan given by the lender after the next paycheck arrives. The providers of instant loans do not want collateral at the time of offering these loans. For this, these loans get the tag of being unsecured.

The lender wants some form of verification of employment or paycheck confirmation like past bank statements for 3 months in typical payday loans. Furthermore, you have to provide the prospective lender with some basic documentation like a PAN card or residential proof like a Driving License, an Aadhaar card, and so on.

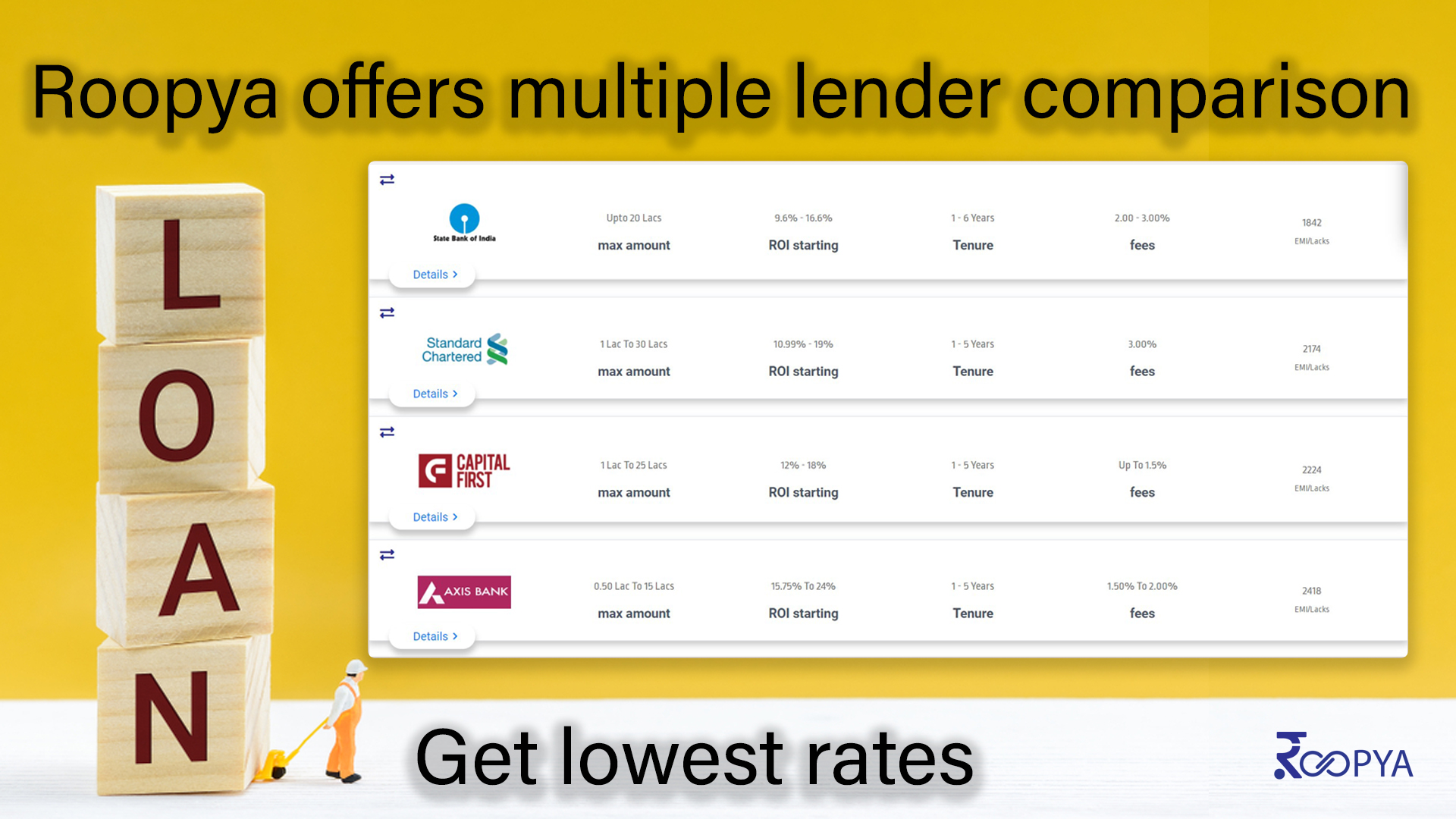

Choose from Multiple Payday Lenders

There are multiple payday lenders in in India. With Roopya you can choose your payday lender according to interest rates & other parameters.

Compare Here: Instant Loan Interest Rates

Paper Application

In the case of the traditional method, a person can go to the payday lenders’ office along with the needed documents to get a small personal loan. He or she obviously has to repay the personal loan by the next paycheck. If the payday loan borrowers become failure to do so, they will be able to repay it at a later point in time. But, the person should keep one thing in mind that he will have to pay a bit more for the high-interest rates.

The borrower should have to offer an ECS mandate or write a post-dated cheque for proffering payment for the instant personal loan. Generally, the date stated on the post-dated cheque correlates to the due date for the personal loan. It is to be noted that if the borrower does not have enough funds in his account, he has to pay the applicable check or ECS bounce charges to the bank on top of the amount that he had to pay to the lender as interest along with the loan amount.

Online Application

It only was a matter of time before the providers of immediate loans ventured into the same more or less with every field going to the online foray. People who want instant payday loans will have access to multiple online lenders of instant loans. Moreover, they obtain the amount of loan directly transferred into their accounts within minutes. A person can depend upon instant loans for several emergency situations and small needs.

You should always remember that payday loans are not suitable options for bigger purchases like a down payment for a home or car. In such cases, you may have to pay a quite big amount as these are only made for short tenures. Instant loan providers mostly will offer approximately 90% of the borrower’s monthly salary according to the given payslip. However, the loan amount can be lower or higher as per the profile of individual applicants. Also, the amount relies on your residing state and sometimes certain other smaller parameters like your credit history.

Online payday lenders mostly offer same-day instant loans. The borrower only has to visit the website of the payday lenders for offering some basic details like a PAN card. He or she will be credited with the amount in his account within a few minutes. The applicant must fill the key details out like name, contact numbers, address, correspondence address, DOB, identity proof, details of employment most importantly. With this piece of information, your lender might check the eligibility for instant online payday loans.

Once the borrower fills the application form out and submits it, the lender would review and approve the loans taking some time. After reviewing the payday loans application, he will process the loan and send it to the provided account of the borrower.

Features and Benefits

Features of payday loans

You need to perceive the features of a payday loan prior to determining to apply for it. The following points will illustrate the features.

- Customers will be able to withdraw a small amount under these schemes as loans with a short-term repayment.

- Borrowers should repay the amount they have borrowed on the next date of income or receive a salary from another source like pension, social security, and so on.

- Generally, the due date of payday loans ranges between two weeks and four weeks starting from the date of borrowing. The lender conducts the agreement of the instant loan. It consists of the particular date on which the customer should repay the loan completely.

- Under this scheme, the amount might be paid out through a prepaid credit card, cheque, and cash. The amount will be deposited online into the borrower’s account provided in the application.

- Generally, both the loan processing and approval process of payday loans is fast.

- Lenders mostly who provide these sorts of loans do not check the applicant’s credit history.

- Coming to the requisites to apply for this loan, usually, the lenders do not ensure a very rigid policy related to the same.

- Customers do not have to offer any collateral or guarantor as security for securing credit under this scheme as it is an unsecured loan.

- Usually, the lender who provides these loans does not verify whether the applicant is able to repay the loan while gratifying his other financial obligations.

- It is previously mentioned that payday loans do not need any guarantor or collateral. Thus, there can be extremely high risks associated with these loans. Also, it denotes that the rate of interest charged for these loans is very high usually.

Benefits of payday loans in India

If you are thinking about enduring a payday loan, you must acquire knowledge about the core benefits of this scheme. You can have a bucket of benefits with these loans. The points below will devise the benefits shortly.

- The process of loan application and approval for this personal loan that you have to go through is very simple. In comparison with the applications of other loans through the bank, this process is hassle-free.

- You can get the payday loans in less than 24 hours starting from the submission time of the application. For that, you have to make sure all the needed documents are in order. Besides, you pass the verification process by the lender quickly. Thus, these sorts of loans are also colloquially known as quick cash loans.

- Previously devised that these loans ensure one of the highest APR (annual percentage rate) among other loans. Still, these can be most profitable in the long run than many other traditional loans if you ensure on-time repayment.

- These loans can be availed by customers for repaying their bills along with other expenditures of household even if the exhaustion of their monthly salary. It can succor them in ignoring several penalties like a late mortgage fee, delay in credit card payment, a bounced cheque fee, and so on.

- Also, customers can avail of payday loans in India having a missing credit report or a bad credit history.

- You do not need any guarantor or collateral for securing these types of loans.

- This loan assists the borrower in being independent as it provides cash instantly if he has some financial crunches.

- Customers get allowed by these loans to gratify any urgent crisis of finance.

- This loan can be applied by the borrowers even if they have several active loans already, without the threat of impacting their credit score.

- Both offline and online methods are available to apply for this loan.

Limitations

Everything ensures some qualities and deformities. The scenario is the same for payday loans in India as well. Thus, prior to applying this sort of financial plan, you should understand its limitations. The following points will explain them briefly.

- You can get these loans for a short tenure. Thus, a payday loan does not suit well for a long-run financial crisis that can last for some months or more than that.

- The applicant needs to be a full-time employee and have a regular income source. Otherwise, he or she won’t be able to get eligibility for this loan. If the person is a part-time employee or has some unemployment benefits, he won’t get this loan.

- For securing this loan, the applicants should have a current bank account. You may have the chance of getting rejected for your loan application. Usually, this may take place if the borrower does not have an active current bank account.

- Generally, these loans are charged extremely high. The fees associated with the loan might get double if the loan is not completely repaid by its due date.

- Previously illustrated that the APR of these loans is high. Thus, the customer might have the chance to pay a high amount of interest.

- If the customer does not ensure on-time repayment payday loans in India might culminate in being very expensive than many traditional loan schemes.

- With the utilization of these loan schemes, borrowers can borrow a small amount only. But, think that if the borrower needs a larger sum for gratifying his financial constraints. These loans won’t be well-costumed for his requisites in this situation. For that, he might consider any other financing options.

- A borrower might overestimate his capabilities of repayment while applying for this loan. This can result in availing a bigger sum than the original requirement. As the customer has to pay high charges, he may get into a high debt trap. It may cause difficulties in repayment of the loan.

- If you apply online for this loan, you may get offered by a crooked and deceitful source. Thus, opting for a trustworthy and genuine lender is crucial as he won’t resell the borrower’s information.

These loans are designed for those people belonging to the working class that faces difficulties in making ends meet. Borrowers should repay the loan within seven to sixty days. However, it completely depends upon the loan providers. Moreover, the urgent nature of the loan, risk of repayment, and short tenure make these options costly payday loans.

But, people want to take it for their convenience to meet their emergency. Payday loans in India are utilized for life events like medical emergencies, wedding loans, fees of school, and so on.

Why Get a Payday Loan from Roopya?

There are a number of lenders that offer these loans. But a question can poke into your mind- “Why should I choose Roopya over others?”

Continue reading this article to perceive the reasons.

Security

Being a direct lender, we remove the risk of sharing your personal and financial information with any outcast lender. Thus, it denotes that your information is safe and secure with us always.

Choice

Choosing us will denote that you are doing business with a verified and licensed direct lender of payday loans in India. We can assure you that with us, you will get the best rate most conveniently. You become our customers after getting the approval.

Besides, you will get the ultimate peace of mind as we will treat you with excellent service. Roopya can offer hassle-free and simple subsequent borrowing.

Prompt and Convenient

If you have a current active bank account with other personal information, you just have to complete the loan application. Once complete, you will receive your approval as well as funding. This is far better than looking for a broker for getting a lender. Choosing Roopay means you choose a direct lender straight from your home comfort.

You will be kept informed

Roopya can keep you informed by using the latest industry update on its webpage. It will assist you with the feeling of comfort that you can make well-informed decisions through us each time while applying for a loan. We can help in reducing your chase and offering you payday loans in the most secured and fastest way.

Nil documentation practically

We just need your PAN number and active mobile number. With these, we will assess your eligibility and pull up your credit report. You do not have to ensure filling a lengthy form or provide the photocopies of your documents.

Superfast turnaround time

The entire process may need less than five minutes. With us, you can get the much-required funds into your hands in minutes.

Reasonable rates of interest

Roopay provides value to your financial aspects. It ensures the lowest interest rates for this loan. Also, the applicants can avail of extra discounts with early and more frequent repayments.

FAQs

What is the average interest rate charged on payday loans?

You may get this loan instantly. Usually, the rate of interest will be 1% per day.

How much do I need for processing and disbursing a payday loan?

As these loans are instant loans, they can be processed as well as disbursed the same day.

Can I ensure an online application for this loan?

Of course, you can. Payday loans mostly are applied online on the mobile app or website of the lender.

How can I use a payday loan?

You can use them as per your requirements. Right from home repair to paying medical bills, you can use them accordingly. Hence, there is no question asked usually about the utilization of the loan amount.

Who can get qualified for a payday loan in India?

Anyone who is at least 18 years old and a full-time employee is eligible for this loan. You should possess an active bank account or a debit card connected to your account.

Can I get these loans if I am a self-employed individual?

Yes. You will need to own a checkbook as well as a check guarantee card for meeting the requirements of lenders mostly.

How will I get the loan amount?

If your payday loan is approved, the amount will rapidly be transferred electronically to your bank account. Generally, the transfer procedure takes minutes.

Do I require any collateral or security?

No, there is no need for any security. In an online payday application, you let the lender deduct money electronically from your bank account while repayment. They can ensure this step once the employer deposits your salary directly to your account.

What if I have less-than-stellar credit?

It won’t be a problem at all. Usually, lenders do not check your credit statement in cases mostly. If you have a bad credit score and they check, you will still get a payday loan. You won’t be eligible for such loans if you are hit by bankruptcy, which is rare.

What if I cannot repay the loan?

If this happens for any reason, payday loan companies mostly will provide you with an opportunity to interact with them. You will be able to negotiate some sort of settlement. But, you should be cautious at this time. If you are unable to meet this, the lender may force you for going into collection procedures.

19,797

Leave a Comment

Your email address will not be published. Required fields are marked *