Axis Bank Freecharge Plus Credit Card

Axis Bank Freecharge Plus Credit Card offers exciting welcome bonus with cashback on each transaction. Read all the features here in this article.

Axis Bank Freecharge Plus Credit Card offers exciting welcome bonus with cashback on each transaction. Read all the features here in this article.

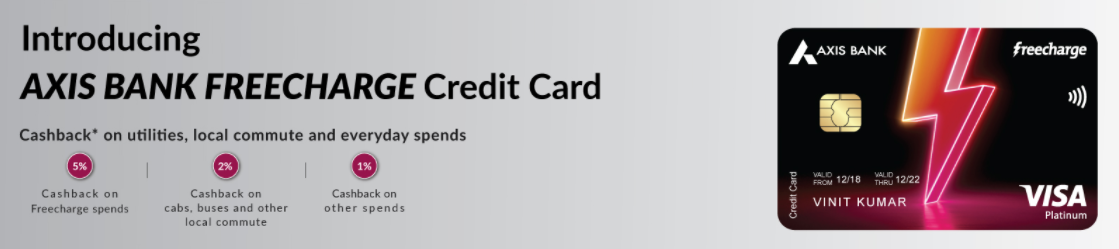

Axis Bank Freecharge Credit Card unlocks huge cashback on Freecharge spends, daily travel & shopping.

This card has been brought to you in collaboration with Freecharge and Axis Bank. It is meant to provide you benefit with all the daily benefits to pay your bills and other purposes. Customers enjoy various offers vouchers and cashback.

Let us know more about the Axis Bank Freecharge Plus Credit Card.

Image credit: Axis Bank

Image credit: Axis Bank

| Welcome Benefits | Get Rs. 350 voucher from Myntra on card activation |

| Rs. 350 voucher from Big Basket | |

| Spending Benefits | Annual fee of Rs. 350 waived off on spending Rs. 50,000 yearly |

| Cashback Benefits | 5% cashback on all spends made on Freecharge |

| 2% cashback on Ola, Uber spends | |

| 1% cashback on all other spends | |

| Dining Benefits | Up to 20% discount with Dining Delights Program at partner restaurants. |

| Annual Fee | Rs. 350 [waived off if yearly spends exceeds Rs. 50,000] |

| Joining Fee | Rs. 350 |

| Financial Charges | 3.4% per month |

| Card Replacement Fee | Rs. 100 |

Table of Contents

There are various offers and features that Axis Bank offers with this credit card. Here are the exclusive features of the Axis Bank Freecharge Plus Credit Card-

There are various welcome benefits that customers who avail of the Axis Bank Freecharge Plus Credit Card for the first time. These are the Welcome Benefits-

You will also get cashback after you make any transaction with Axis Bank Freecharge Plus Credit Card.

Just like other credit cards, Axis Bank Freecharge Plus Credit Card offers Dining Delights program.

If you spend more than Rs. 50,000 in a year through Axis Bank Freecharge Plus Credit Card, you will not have to pay the annual fee.

These are the shopping benefits that you will be able to enjoy with the Axis Bank Freecharge Plus Credit Card-

Want to compare with other cards? Visit Compare Credit Cards.

To get an Axis Bank Freecharge Plus Credit Card you will also have some limitations. These limitations are set by the bank on various factors. The credit limit is decided by evaluating the credit score, ongoing debts, employment, annual income, habits for repayment, etc.

There are various eligibility criteria that you must fit in to apply for the Axis Bank Freecharge Plus Credit Card. The required eligibility criteria are listed below-

To apply for the Axis Bank Freecharge Card, you should reside in India or have citizenship in India.

The age of the applicant to obtain an Axis Bank Freecharge Plus Credit Card should be at least 18 years of age or above.

The applicant should be self-employed or salaried.

Having an excellent credit score helps to get the approval of the Axis Bank Freecharge Plus Credit Card much more easily.

Know about other Axis Bank credit cards: Axis Bank Platinum Credit Card | Axis Bank Reserve Credit Card

Documents are very important for the verification of credit card approval at every bank. You need to have solid proof that you are eligible for the Axis Bank Freecharge Plus Credit Card.

These are the important documents that you need to submit to the bank for verification of further processing. On the basis of these documents, you will proceed to further steps-

To submit the documents for identity proof, you will require these documents-

These are documents that you will require for residential proof for Axis Bank Freecharge Plus Credit Card-

For income proof, you will require these following documents to access Axis Bank Freecharge Plus Credit Card-

You will have to keep the fees and charges of your Axis Bank Freecharge Plus Credit Card. So that, you pay your bills on time and maintain a good credit history The Fees and Charges of Axis Bank Freecharge Plus Credit Card are-

These are the steps that you need to follow to apply for the Axis Bank Freecharge Plus Credit Card-

These are the Frequently asked questions about the Freecharge Plus Credit Card from users across the country.

The Axis Bank Freecharge Plus Credit Card is an entry-level credit card, You can pay the dues of your is Bank Freecharge Plus Credit Card through Paytm, Gpay, Net Banking. This process is fast and easy as well.

The is Bank Freecharge Plus Credit Card is just like other virtual credit cards launched recently by Axis bank and Freecharge. You can get gift vouchers worth Rs. 350 for Myntra and Big Basket for online shopping. You can also use this card for other spends such as paying your bills, shopping, food, etc.

After you make any payment using the virtual card, you will receive the vouchers within 21 days of payment. You will receive these vouchers online on your registered email id or mobile number.

Yes, the Freecharge Plus Credit Card Axis bank offers an annual fee waiver if your annual spends reaches above Rs. 50,000.

Yes, you can use Frecharge mobile app for your bill payments Axis Bank Freecharge Plus Credit Card. You can use reward points with freecharge spends and redeem reward points as well.

Yes, we recommend Axis Bank Freecharge Credit Card. You can use the physical credit card or even freecharge wallet for your payments and gain unlimited cashback and reward points.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior