Instant TATA Capital Personal Loan

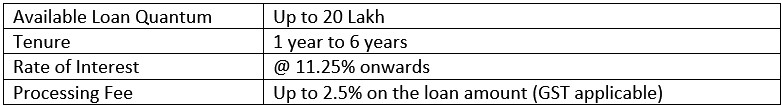

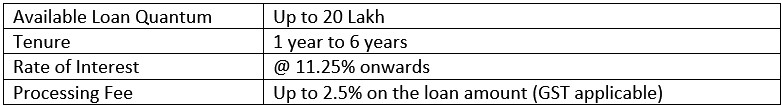

Instant TATA Capital Personal Loan comes with a loan quantum of up to 20 lakh for up to 6 years of tenure. The fixed interest rate starts from @ 11.25% onwards and has a part-payment and pre-closure facility. Apply instant personal loan online here.

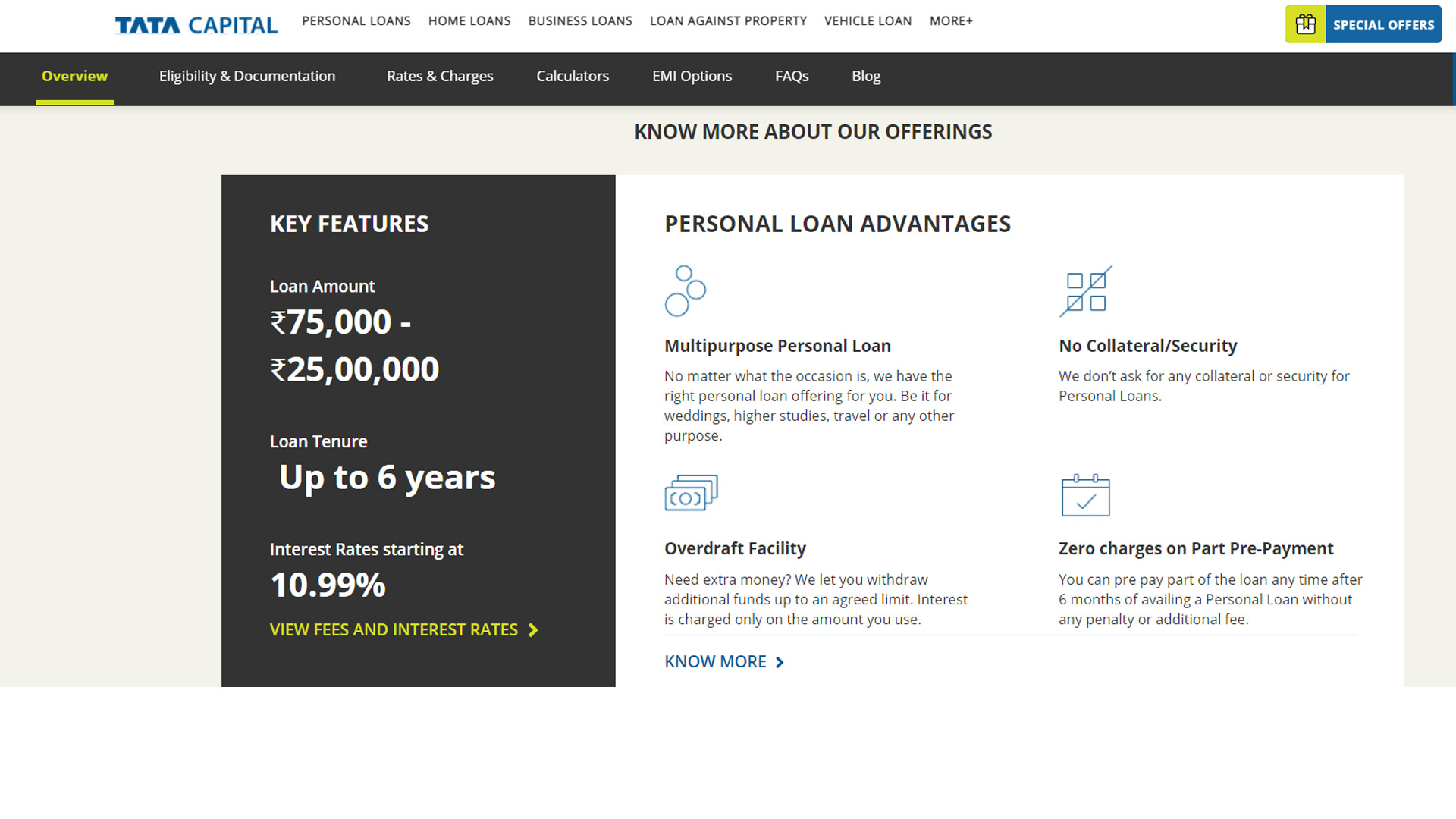

Features of instant TATA Capital personal loan online

There are multiple beneficial features of TATA Capital Personal Loans.

- No collateral or guarantor is required to apply TATA Capital personal loan online

- Competitive fixed rates of interest are available starting from 11.25% if you apply Tata Capital personal loan online

- Flexible tenure of up to 6 years is available for repayment.

- Zero fees on preclosure.

- A part-payment facility is available if you apply instant TATA Capital personal loan online

- Get service at your doorsteps.

Criteria to apply instant TATA Capital personal loan online

Eligibility Criteria apply TATA Capital personal loan online

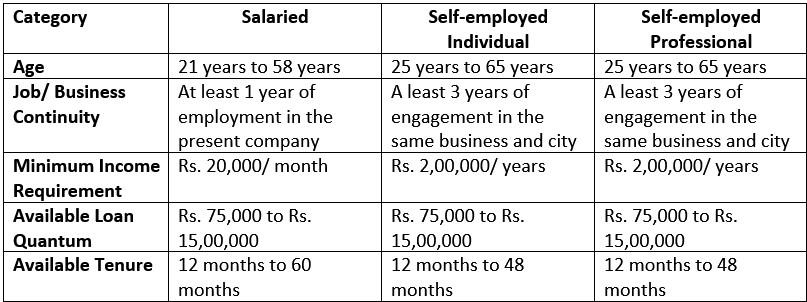

The eligibility criteria to apply for TATA Capital personal loan online is different for salaried persons, self-employed professionals, and self-employed individuals. A salaried person should be employed in an MNC, PSU, private or public company, or any government establishment, whereas, a self-employed person can be an individual or a professional.

Documents required to apply instant TATA Capital personal loan online

To prove the eligibility to apply for TATA Capital personal loan online, a processing fee cheque, photocopies of the borrower’s Voter’s ID card, PAN card, Passport, Driving License, bank statements of last three months or bank passbook of the last 6 months will be required along with the signed application form with photograph. Besides, applicants must submit income proofs according to their professions.

| Salaried Person |

Self-employed Person |

| Salary slips |

Bank statement |

| Salary Certificate along with Form 16 |

Income Tax Return or Form 16 |

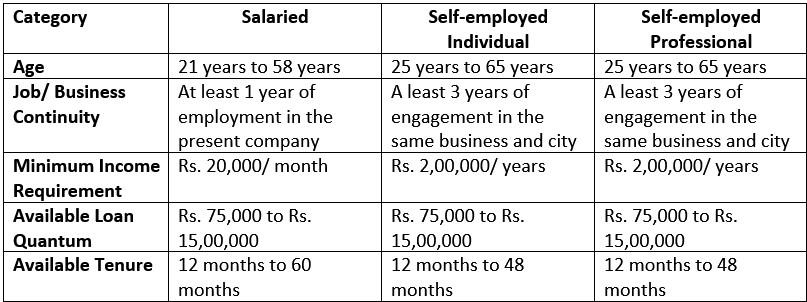

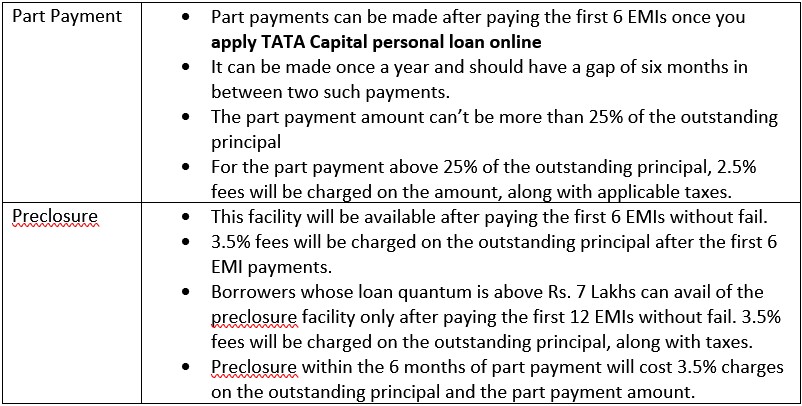

Conditional Part-Payments And Preclosure Facility Once You apply instant TATA Capital personal loan online

TATA Capital Personal Loan provides the flexibility of conditional part payment and preclosure of the loan account at the following rates.

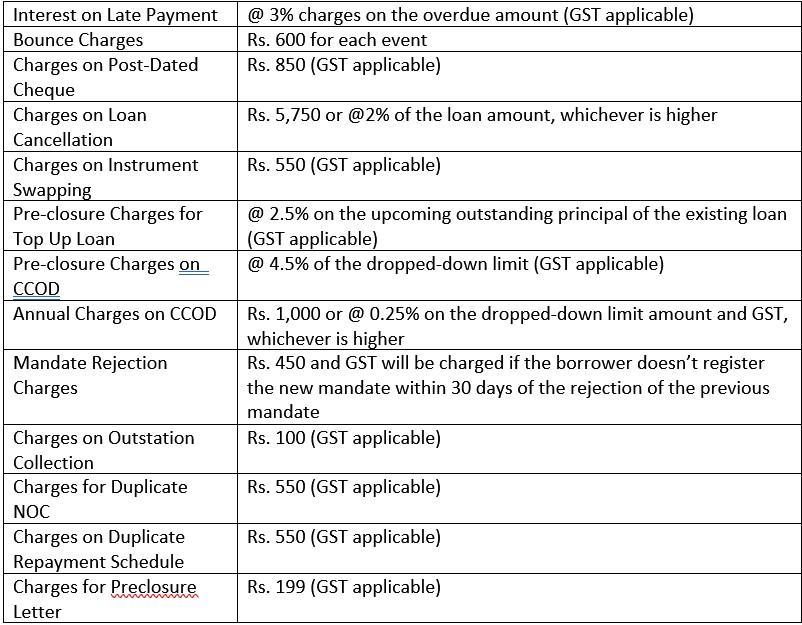

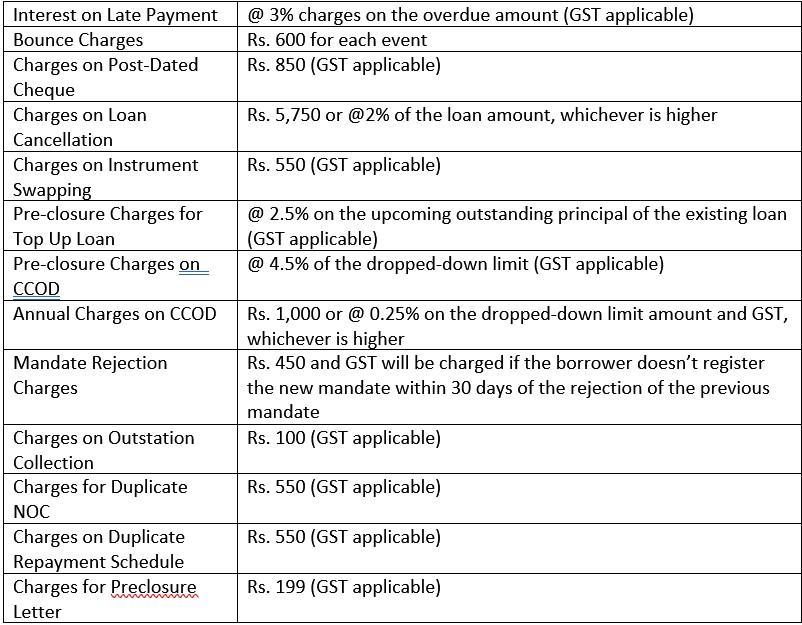

Fees And Charges You Should Know If You apply instant TATA Capital personal loan online

Apart from interest, processing fees, part payment fees, and preclosure fees, TATA Capital Personal Loan can have the following charges and fees also.

How To Use the EMI Calculator before You apply for instant TATA Capital personal loan online

At Roopya’s official website, borrowers can use the EMI calculator to get an overview of their repayment amount and EMIs for the TATA Capital Personal Loan. They only have to put the loan details such as loan quantum, tenure, rate of interest, and processing fee. Then one click on the ‘calculate’ button will generate and show the estimated repayment and EMI amounts. And a table there will show you the thorough break-ups of the repayment schedule.

FAQs

Here the answers to some frequently asked questions about the TATA Capital Personal Loan to make your perception clear.

-

Can I track the status once I apply for an instant TATA Capital loan online?

Yes, you can track the status through e-mails and SMS. Applying through Roopya will also empower the borrower to track the status by simply visiting his or her Roopya account. Or they can contact the customer care department of Roopya or TATA Capital.

Click here to know about: Instant cash loan

-

What are the advantages apply instant TATA Capital loan online through Roopya?

At Roopya, you will get the best rates of interest and loan quotations to avail of the TATA Capital Personal Loan, along with complete assistance in the loan processing.

-

Can I get a loan statement online?

Yes, you can receive the online loan statement on your registered e-mail ID.

-

Are TATA Capital Personal Loan borrowers eligible for the loan moratorium?

Following the RBI guidelines, the TATA Capital Loan borrowers are eligible for the loan moratorium. But the accumulated interest of the moratorium period will be included in the upcoming installments.

-

Does applying for the moratorium affect my upcoming EMIs?

Yes, it will affect the upcoming installments as the accumulated interest during the moratorium period will be included in the remaining EMIs.

-

Do I have to pay a processing fee to apply for instant TATA Capital loan online?

Depending on the loan amount and tenure, you have to pay a processing fee on the TATA Capital Personal Loan amount.

-

Can I get the TATA Capital Personal Loan for my business?

Yes, you can get and use the TATA Capital Personal Loan for your business also.

-

When can I get a top-up loan on my existing TATA Capital Personal Loan?

You can get a top-up loan on your existing TATA Capital Personal Loan after paying 8 to 18 EMIs.