Deduction for home loan is an important matter of 2021 budget. The dream of having their own home matters a lot to the people who are living under a rented roof and spending a massive part of their income as house rents. And despite paying the rent there are a lot of restrictions made by the landlords that tenants have to follow. So people opt for home loans to turn their dream into reality. And now the dream is supported by the Indian government as the fresh budget for the financial year 2021-2022 has a surprise for the Indian citizens. To apply for home loan in India, visit our page.

Table Of Content

- The Deductions Before The Current Budget

- What Does the Current Budget Offer?

- The Reasons the Relief in Deductions

- How would the Borrowers get Benefited?

- Conditions One Should be Aware of

The Deductions Before The Current Budget

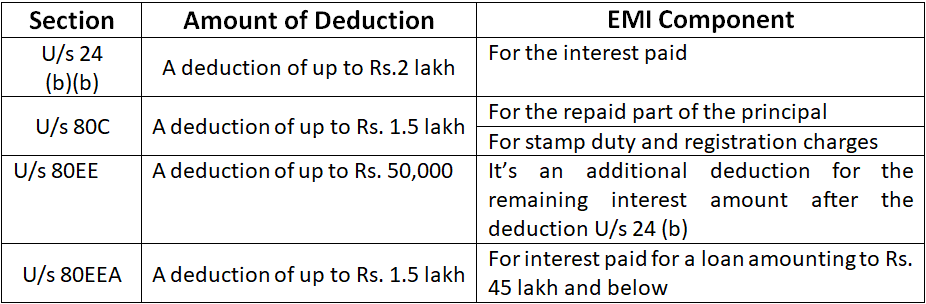

Home loans help you to buy a new home or a flat for yourself. And end up repaying the loan along with an interest for a certain period of time. Usually, the home buyers of urban areas pay several lakhs of interest per year. And claim for the deductions from their payable income tax for the interest and principal paid. Till the F.Y. 2020-2021, a home loan borrower was eligible for the following deductions for a loan for their self-occupied house based on the respective EMI components.

So the total amount of deduction for home loan interest was Rs. 3.5 lakh. The 80EEA deduction was only available to the home loan borrowers who have borrowed the loan between 2019-2020 which was extended to 2021.

What Does the Current Budget Offer?

The budget that was presented on 1 February 2021 by India’s honorable Finance Minister Mrs. Nirmala Sitharaman has something relaxing for the taxpayers of the F.Y. 2021-2022. The 80EEA deduction period has been extended for another year. It means the home loan borrowers of 2021-2022 will be eligible for the total deduction on home loan interest of Rs. 3.5 lakh.

The Reasons the Relief in Deductions

The main reason behind this decision is the concept of ‘Housing for all’. The last year was a roller coaster ride for our economy too as we are a part of the global economy that suffered pathetically. The loss of life and jobs caused utter turmoil for the industries and real estate is a major part of it. The financial crunch took the graph of buying new homes down which resulted in irreparable financial losses. And to revive the financial flow, the real estate industry requested some relief for the taxpayers so that people can opt for buying their own homes.

How would the Borrowers get Benefited?

Apparently, the purpose may seem solely made for the real estate industry, but the benefit that a home loan borrower will get is commendable. The deduction U/s 80EEA was there only for the borrowers who have borrowed the home loan amount in the F.Y. 2019-2020 and 2020-2021. But the deduction for home loan U/s 80EEA will be available for another year. This clause will surely benefit the home buyers who are still planning for it. The home loan that is Rs. 45 lakh or below so, will be able to get the deduction.

As per previous instruction, here is an example to understand the tax deduction that you can avail of. If a borrower has taken a home loan amount of Rs. 40 lakh @ 10% simple interest per annum to buy a self-occupied house or flat, he has to pay Rs. 4 per year as interest. Now, while filing the tax, he will be eligible for the deduction of Rs. 2 lakh and Rs. 1.5 lakh U/s 24 (b) and U/s 80EEA, respectively. So the total deduction for home loan will be Rs. 3.5 lakh. And the taxable interest amount will be Rs. 50,000. The same will be applicable for the home loan borrowers who are going to borrow in F.Y. 2021-2022 and file tax in A.Y. 2022-2023. And the deduction will be constant until any new amendment.

The whole thing will provide relief in tax payments. Thus the borrowers can save some prominent amount on tax and make a fund for their other purposes. This declaration will surely boost the economy to some extent.

Conditions One Should be Aware of

The conditions behind the deduction for home loan should be well known to avail of the relief.

- The additional deduction of Rs. 1.5 lakh U/s 80EEA is only applicable for the interest upon a stamp duty value of the property of Rs. 45 lakh or lower than that.

- Only the loan taken in between 2020 and 2021 will be eligible for the deduction.

- Your lender must be a bank or a housing finance company.

- If a taxpayer avail of the tax deduction U/s 80EEA, then he or she won’t be eligible for the additional deduction U/s 80EE.

- The taxpayers who own other residential properties on the date of loan sanctioned are not eligible for the deduction for home loan U/s 80EEA.

- The bought property should be of 60 sq. meters and 90 sq. meters in a metropolitan city and another city, respectively.

Bottom Line

The latest bill for the deduction for home loan is the most time-worthy decision that will make the ‘Housing for all’ effective as more people can now avail of home loans to buy their own roof. Let us know how helpful the article is and you can mail us for any other loan related clarifications.

Resources

25,717

Leave a Comment

Your email address will not be published. Required fields are marked *