Axis Bank Ace Credit Card

Axis Bank Ace Credit card offers a minimum of 2% cashback on every transaction. Get your Axis Ace Credit card today. Apply with Roopya.

Axis Bank Ace Credit card offers a minimum of 2% cashback on every transaction. Get your Axis Ace Credit card today. Apply with Roopya.

Axis Bank launches Axis Bank Ace Credit Card with Google Pay tie-up to provide 2-5% cashback on all transactions.

There are times when you might need cash or money in any form to fulfill your instant needs. In such a situation, when you have a Axis Bank Ace credit card, you are less worried as you are already aware of how it can help you.

Though it is also similar to taking a loan from the bank, you have the discretion to decide how much to spend so that you can easily repay, right? Well, if you are among those who are more often into spending through credit cards, the Axis Bank ACE credit card is for you.

Axis Bank Ace Credit Card not only gives you an opportunity to spend whenever you want to but also offers you a cashback on the expenditure you make. Isn’t that great?

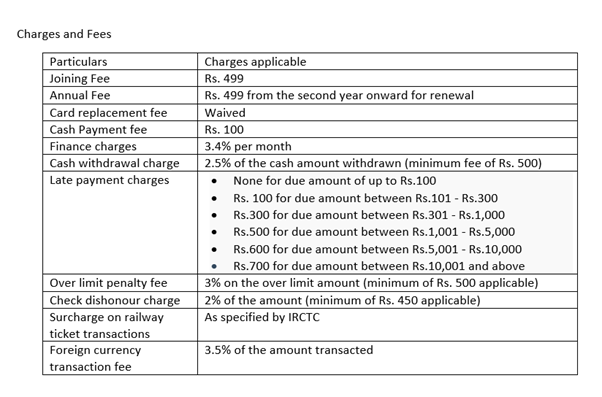

Well, of course, it is, when you only get cards that charge you interests. With Axis Bank ACE credit card, which is available at an annual fee of Rs. 499, life becomes easy as managing expenses is more convenient with lenient cashback.

| Joining Fee | Rs. 499 (Reversed on spending Rs. 10000 within 45 days) |

| Annual Fee | Rs. 499 (Reversed on annual spend of Rs. 2 Lakhs or more) |

| Cashbacks | 5% Cashback on bill payment, recharge via Google Pay |

| 4% Cashback on Zomato, Ola, Swiggy | |

| 2%Cashback on other spends | |

| Airport Lounge | 4 Complimentory domestic lounge access per year |

| Add-on Card Fee | Nil |

| Card Replacement Fee | Waived off |

Looks good for you?

Roopya offers the fastest way possible to apply for a credit card. Follow these steps to apply for Axis Bank Ace Credit Card:

If your application is approved, you will receive a confirmation message on your registered number. An executive will call you to further the process accordingly.

Here we will talk about the Axis Bank Ace Credit Card, its features, eligibility criteria, application process, and many more. To know more details of this credit card, read below.

Table of Contents

Axis Bank ACE credit card makes spending worry-free by promising cashback every time you use it. Whether you buy clothes and accessories using this card or you pay your electricity or phone bills, this card has a cashback to offer to its customers.

For bill payments through Google Pay, the ACE card provides 5% cashback while for other purchases; you will be eligible for 2-4% cashback.

Apart from the aforementioned reasons, there are other factors too that you might come across while reading an Axis Bank ACE credit card review to convince you how having this card is a good idea for you all. Some of them include:

The above-mentioned luring and attractive deals that you get to enjoy when you have Axis Bank’s ACE credit card in your wallet are enough to make you understand how using the card could benefit you in enormous ways. Making an application is quite easy.

Once you are done with the formalities, you will receive your Axis Bank ACE credit card details to begin making purchases.

Want to compare with other cards? Visit Compare Credit Cards page.

If you go through the Axis ACE credit card review, you will get a chance to browse through different maximum benefit options that makes this card an all-in-one financial solution for people. This is the card of the people introduced for the people.

Though the credit card does not offer any cashback for the EMIs you pay, the standard Axis Bank ACE credit card features are still enough to keep you convinced. Below are some of the Axis Bank ACE credit card benefits that you must know about:

The first and foremost thing that attracts people to apply for the Axis Bank ACE credit card is the cashback provisions it has.

There is no limitation to the number of cashback you get. You are eligible for the same every time the card gets swiped. Who doesn’t want to get some returns on the expenditure? Everyone wants it.

When you pay your electricity and phone bills or you are getting a recharge done, you can expect a cashback of 5% on the amount spent for the purpose. This amount gets credited to your bank account directly without delay.

Apart from bill payment, if you spend on other things, you can expect a cashback of 2-4%. To note here is that the cardholders don’t get any cashback for the EMIs they pay using this credit card.

When you are paying for fuel using this card, your surcharge on it gets waivered. As a result, you get a chance to save a lot on the amount you regularly spent on fuel stations purchases. Using this ACE credit card, you get a 1%fuel surcharge waiver.

This is applicable in any fuel station you buy fuel from in India. However, there is a minimum amount you need to spend on fuel purchases to ensure you get the waiver. Also the third parties should have a tie up.

The transaction value should range between Rs. 400 and Rs. 4,000. The maximum surcharge waiver you can expect to get on a monthly basis would be up to Rs. 500.

Hence, if you use your own vehicle for a regular commute, this fuel surcharge waiver feature of the credit card would surely help you save enough amount on fuel expenditure.

Being the Axis Bank ACE credit cardholder, you get special treatment at the domestic airport lounges. Surprised?

Well, if you have this credit card, you are allowed complimentary access to domestic airport lounges. The bank allows this facility to the cardholders four times in one calendar year. So, if you travel three to four times a year, this credit card would be a fruitful asset for you.

Pay a visit to the lounge of your nearest airport and enjoy the special treatment four times a year being the trusted credit card customer of the Axis Bank.

Are you planning for dinner outside? Or do you prefer frequent dining with family or friends at posh restaurants? If yes, your ACE credit card can give you the best deals on dining.

There are over 4,000 partner restaurants of the bank all across India. You can choose any one of them to experience the best dining experience with your loved ones, thereby getting huge discounts.

If you pay using an ACE credit card, you can get a discount on your bill amount. This could range to up to 20%.

So, now you know quite well how this ACE credit card from Axis can help you lead a luxurious life.

Then, what are you waiting for? Applying for the card is really easy and smooth. You just need to visit the bank’s official website and apply online along with the documents as asked for. Go for the credit card apply option and make yourself eligible to enjoy the advantages it brings to your table.

Know about other 5 axis bank cards:

While the methods of making an application for Axis Bank ACE credit card are known to you along with the benefits you can enjoy if you are the cardholder, there is one thing that you should not miss out on. Yes, before you make an application, it is important that you check your eligibility criteria.

The bank will verify everything, including consumer credit information with the credit information bureau. Knowing the criteria will let you be assured that you are eligible for making the application.

However, if by any chance, your application is rejected given the non-fulfillment of any of the criteria, you should be aware of where you lacked.

Here is a list of criteria that you would require fulfilling:

Read more: Credit Score

Your application needs to be supported with certain documents, which the bank verifies before approving your application of owning the Axis Bank ACE credit card. The list of documents required has been shared below:

The maximum cashback percentages applicable for the ACE card are as follows:

Let’s understand how the Axis Bank ACE credit card’s billing cycle works:

Mr. X spends Rs. 3,000 for paying his bills and recharging DTH. He orders food worth Rs. 5000 using Zomato and spends Rs. 15, 000 on other stuff, which included an EMI of Rs. 7000. Thus, Mr. X spent a total of Rs. (3000+5000+15000) = Rs 23, 000 in a billing cycle.

However, as EMIs are not eligible for cashback, the amount that will be considered for cashback would be = Rs. (23000 – 7000) = Rs. 16,000

Total cashback Mr. X would receive for one cycle = Rs. (150+200+160) = Rs. 510

Like any other credit card that you use, the Axis Bank ACE Credit card also has some reward points for the cardholders. Depending on annual spending & over-limit amount, Axis Bank will offer you some reward points for your loyalty and trustworthy consumer credit report.

While filling the application, it is important for you to go through the terms and conditions properly before signing and agreeing to the clauses.

If you desire to know about the terms and conditions related to the use of the ACE card, you can visit the terms and conditions section on the website and go through the Card Member Agreement, Code of Commitment, and MITC (Most Important Terms and Conditions).

Also, you should know to what extent the market risks affect these cards’ T&C.

As soon as your application is approved, the banks acknowledge receipt of the application approval and give you an ACE credit card welcome offer or confirmation letter from the bank to start with your purchases immediately after receiving your ACE credit card.

Look for the written instructions of other card fees including finance charges, annual spends limit penalty, joining fee, annual fee, outstation cheque fee before the card issuance.

For more information, you can give a missed call on our toll-free number to know more.

FAQs

An Axis ACE credit card is a cashback credit card that gives you an opportunity to spend whenever you want while receiving a cashback on almost every purchase you make.

You just need to pay a joining fee of Rs. 499* to own it and the same amount yearly as the renewal fees.

The Axis ACE credit card is the best among the list of Axis Bank credit card options as it promises a cashback of up to 5% on every purchase the cardholders make.

It is Rs. 100 per transaction. Check with partner banks before proceeding.

You can apply for the card and once you receive it, you can activate the same either through net banking or mobile app or through ATM.

Through Net Banking

Through Mobile App

The steps to apply for and get a Google Pay Axis credit card are as follows:

With around 11 variants of credit cards, Axis Bank offers options for everything from traveling cards to shopping cards to dining cards to cashback cards.

Get all details of Axis Bank Credit Cards here.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior