ICICI Bank Sapphiro Credit Card

Get ICICI Bank Sapphiro Credit Card to your doorstep. Apply now with Roopya to get maximum benefits on every purchase.

Get ICICI Bank Sapphiro Credit Card to your doorstep. Apply now with Roopya to get maximum benefits on every purchase.

ICICI Bank Sapphiro credit card envelopes exclusive benefits and privileges that will make your card experience really advancing. Be remunerated for all your investments and similar energy, appreciate offers, discounts, exclusive welcomes, and parlor access when you use your ICICI Bank Sapphiro credit card.

Without interest credit periods, fuel overcharge waivers, annual fee waivers, travel, and playing golf privileges, in addition to a personal attendant are yours for the taking. The Sapphiro credit card is on offer exclusively to picked customers of ICICI Bank.

If you want to apply for ICICI Bank Sapphire credit card, then you can apply directly from roopya.com. You can follow the below steps to apply for the ICICI Bank Sapphire credit card.

• Welcome offer: At the point when you become a customer of the ICICI Bank Sapphiro VISA credit card, you will be gifted with a bunch of Bose IE2 earphones.

• Annual fee waiver: The annual fee for this card is Rs. 3,500 from the second year ahead. In the event that you spend more than Rs. 5 lakhs in the earlier year, your annual fee will be postponed.

• Hand-picked rewards: Under the hand-picked rewards conspire, you can improve your shopping experience. Get 2 focuses for each Rs. 100 spent locally. For worldwide spending, you will get 4 award focuses all things considered.

Reclaim the focuses you procure from a wide exhibit of choices that incorporates air miles, clothes, aromas, holidays, feasting, home amusement, and surprisingly hello-tech devices

• Travel privileges: Get a free Priority Pass that gives you admittance to in excess of 600 VIP lounges across the world at every one of the main air terminals. Rest, unwind and spruce up in the middle of your movements regardless of which carrier or class you fly. Parlor charges will be material. Likewise, get VISA relaxation privileges that incorporate 2 free parlor gets to each scheduled quarter at the taking part relax.

• Golfing privileges: Spend in excess of a lakh on your ICICI Bank Sapphiro VISA credit card and get one round of golf free the following month.

• Entertainment privileges: Get welcome to exclusive film screenings. Besides, when you book your film tickets on bookmyshow.com, you can profit from 1 free ticket anytime. In a month, you can profit of 2 tickets worth Rs. 400 for every ticket.

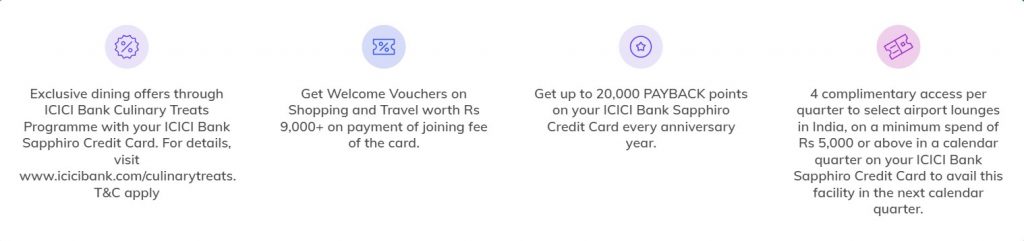

• Culinary treats: Eating out is more satiable with at least 15% off on your bill at any of the taking an interest eaterie.

• Fuel overcharge waiver: Top off your tank at any gas station to get a 2.5% fuel overcharge waiver. Substantial on exchanges up to Rs. 4,000.

• internet-Assist: Your personal attendant at your administration every minute of every day to deal with every one of your necessities. I-Assist can assist you with making lodging, eatery, travel, and vehicle rental appointments. It will likewise give you lodging, café, and flight references. Get roses and gifts conveyed to your friends and family. Indeed, even the benefit of crisis clinical privileges and auto aid India.

The ICICI Bank Sapphiro VISA credit card is inserted with a central processor which improves the security of your card. It gives you extra protection against duplication and forging. Additionally, the additional layer of the Personal Identification Number will guarantee every exchange is checked by you.

Get 18 to 48 days time to pay your credit card bills. Each time you pay your bill in full, a new without interest period will start. You can totally keep away from interest charges by clearing all assertions in full.

Loan costs on your credit card buys can be just about as low as 1.25% each month. Upon defaults and other adverse issues, the greatest interest you can bring about is 3.50% each month.

With this element, you will be secured against misuse or false exchanges on your credit card.

Deal with your record effectively and advantageously on the web. Complete various exchanges including paying your credit card bill through the Internet banking office.

ICICI Bank has a portable application to work with simply relying upon the go. Customers can download the application from the App Store and the Google Play Store. On the other hand, ICICI Bank additionally gives SMS banking offices.

This card is on a proposition to choose customers of ICICI Bank. ICICI Bank claims all authority to offer this card to customers of its decision at its sole caution.

If you are a self-employed person between the age of 21 to 65 you can avail Sapphiro ICICI Credit Card. For salaried individuals, the age limit is between 21 to 58 years. There are several important factors that affect your ICICI Bank credit card eligibility. Below are a few of the primary factors which you should fulfill to avail of an ICICI credit card.

Age Matters: The age of the applicant is one of the primary factors, which decides the eligibility and the repayment capacity of the applicant.

Stable Income: Your income plays an important factor and the chances of your credit card application being approved are high when you have a high monthly income.

Good Credit Score: Credit history is a clear indication of how an individual manages credit-related activities. A high credit score increases your creditworthiness.

Below is the list of documents required to avail a credit card from ICICI Bank.

· KYC documents such as Passport, Voter Id card, Driving Licence, etc.

· Permanent Account Number (PAN) card or Form 60 if PAN is unavailable.

· Income proof such as salary slips and income tax returns.

· Bank or credit card statements.

When will I accept my welcome proposal of the Bose Headphones?

After you pay the joining fee of Rs. 6,000 for the ICICI Bank Sapphiro credit card, you will get the free arrangement of Bose IE2 Audio Headphones inside 30 days.

How safe is it to use my credit card for online exchanges?

Your credit card has been enabled with a CPU and the PIN which is needed at any shipper outlet. For online exchanges, you wanted to enroll for 3D Secure, otherwise called Verified by VISA to guarantee that your web-based exchanges are protected and confirmed by you.

What occurs if I default on my credit card payments?

At the point when you default on a payment, you consequently cause correctional charges. Contingent upon the sum you owe the bank, the punishment will be imposed. Aside from this, your loan cost can be raised up to 3.50% each month. On the off chance that you keep on defaulting on your credit card, ICICI Bank should follow convention and report you to CIBIL. This will influence your credit score. Guarantee you pay basically the base due to stay away from these results.

What are the ways of paying my ICICI Bank Sapphiro credit card bill?

Coming up next are the ways of paying your ICICI Bank Sapphiro credit card bill.

• Drop a check or a DD off at any ICICI ATM or bank office

• Pay in real money at any ICICI Bank office.

• Request that the bill sum be consequently charged from your ICICI Bank account

• You can get to your record through on the web or versatile banking and pay your bill through your ICICI Bank account.

• You can use “Click to Pay” or NEFT to pay your bill through some other financial balance.

• You can likewise call customer care to pay your credit card bill by providing them with all the necessary information.

How do I get my ICICI Bank Sapphiro credit card supplanted?

In the event that your card is lost, lost, or harmed, generously demand another card through the ICICI credit card customer care administration, Internet banking, or at the Bank office. The old card will be obstructed and another one will be issued. The replacement card costs Rs. 100 and will contact you within 7 working days.

What are the documents required for ICICI Bank Sapphiro credit card?

· KYC documents such as Passport, Voter Id card, Driving Licence, etc.

· Permanent Account Number (PAN) card or Form 60 if PAN is unavailable.

· Income proof such as salary slips and income tax returns.

· Bank or credit card statements.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior