HDFC IndianOil Credit Card

HDFC IndianOil Credit Card offers 5% earning on spending. Get this co-branded card from Roopya & enjoy amazing reward points from IndianOil.

HDFC IndianOil Credit Card offers 5% earning on spending. Get this co-branded card from Roopya & enjoy amazing reward points from IndianOil.

HDFC IndianOil Credit Card is a co-branded credit card from HDFC bank & IndianOil corporation. It offers a broad range of benefits for its users to enjoy.

The HDFC IndianOil Credit Card is specifically designed for the users to enjoy great discounts and benefits on fuel transactions.

You can obtain this credit card with a joining fee of Rs. 500. Also, the monthly interest rate is 3.49%. To know more about the HDFC IndianOil Credit Card, you can read further below-

| Annual Fee | Rs. 500 [Reversed if annual spend exceeds Rs. 50,000] |

| Joining Fee | Rs. 500 |

| Avail Lifetime free offer on Smartpay registration | |

| Fuel Benefits | Up to 50 liters of FREE fuel in on year |

| 250 Fuel points per month at Indianoil outlets for 1st 6 months | |

| 150 Fuel points next 6 months | |

| Fuel points are valid for 2 years | |

| 1% Fuel surcharge waiver on minimum fuel transaction of Rs. 400 | |

| Earn 5% fuel points on Indianoil stations, bill payment, shopping | |

| Milestone Benefits | Rs. 500 annual fee will be waived if annual spend exceeds Rs. 50,000 a year |

Want to apply now? Click here.

Table Of Content

There are various features and benefits of the HDFC IndianOil Credit Card. The main highlights of the credit card are as follows-

Compare with other credit cards: Visit compare credit card benefits.

The users of HDFC IndianOil Credit Card enjoy the following advantages-

If you own an HDFC IndianOil Credit Card, you can get 1 Fuel Point on spending Rs. 150 on other transactions rather than the fuel.

Apart from that, you will also get a 5% Fuel Points with the card for groceries and bill payment.

In this category, you can earn around 250 Fuel Points during the initial six months at every IndianOil Petrol Pump throughout the country.

After that, you will also enjoy a fuel surcharge waiver of 1% on every fuel transaction starting from Rs. 400 and above.

Even after completing the first 6 months, you will get 150 fuel points every month.

With this card, you will get the opportunity to earn 5% Fuel Points for every fuel transaction.

Apart from amazing discounts on fuel transactions at various IndianOil petrol pumps, there are various opportunities that you can enjoy.

With this card, you will get a waiver in the first year fee for spending Rs 20,000.

You can automatically update PayZapp with a single transaction worth Rs. 500 under the initial 90 days of issuing the card.

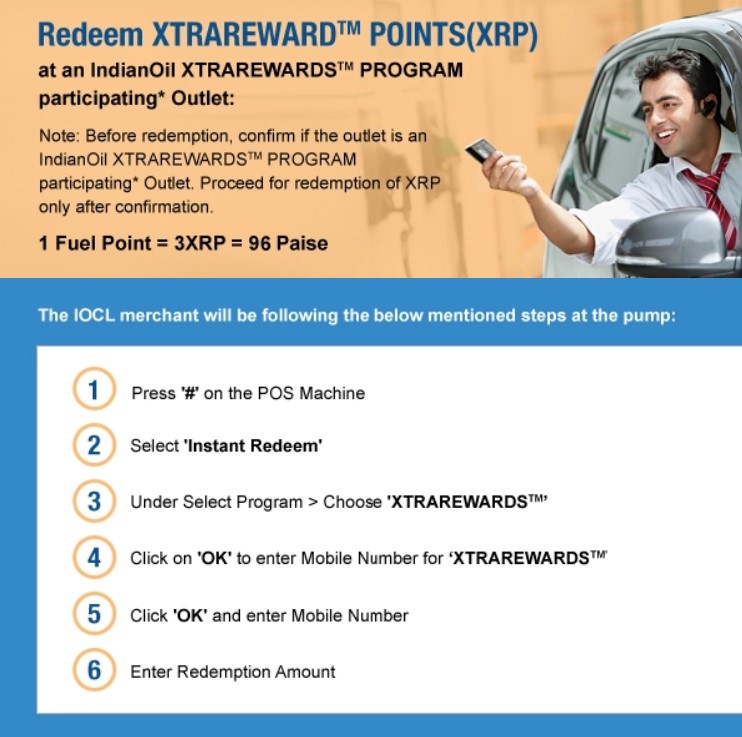

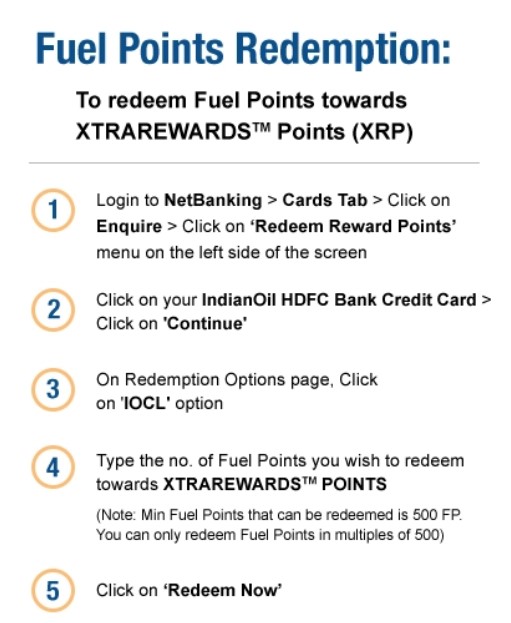

With the IndianOil HDFC Bank Credit Card, you don’t get any reward points. Instead, you will get “Fuel Points” for every transaction with this credit card. You can redeem the fuel points as Cashback. With these fuel points, you can also purchase several items available in the rewards catalog of the HDFC Bank.

Know about Xtrarewards by Indian oil corporation: Visit here.

The limit of the card is assigned by the HDFC Bank. There are various factors that are verified to decide the limit of the card. The most important factors include credit score, ongoing debts, past debts, repayment habits, etc. If you have a low credit score, then it will be very difficult for you to obtain a credit card. Also, you must complete your previous loan before getting a new loan. This can affect the chances of getting a card with increased limits.

To know about the eligibility criteria, you can visit the official website of HDFC Bank. Click on “Check Eligibility” and you can check that you are eligible for the card or not. Below are the few points that you must know about the eligibility criteria for IndianOil HDFC Credit.

Age

The minimum age of both salaried and self-employed and salaried individuals to apply for the card is 18 years. Also, the maximum age to apply for the IndianOil HDFC Bank Credit is 70 years.

Citizenship

If you are applying for a credit card, you must be a citizen of India. Also, you must have valid proof for verification which you need to submit to the bank.

Add-On Card

The bank also provides an add-on card. To get access to the add-on card. The age of the add-on applicant should be at least 15 years or above.

There are various documents that you need to submit for verification. It includes your Identity proof, address proof, and income proof. To know more about the primary details, read further below-

For Identity proof, you must produce the following documents-

For address proof, you will need to submit the following-

You also need to submit income proof with your application. You will require-

The fees and penalties for various purposes of the HDFC IndianOil Credit Card are as follows-

Joining Fee– To obtain IndianOil HDFC Bank Credit card, you have to pay a joining fee Rs. 500.

Annual Fee- Rs. 500.

Finance Charges– 3.49% every month

Fee for Cash Advance– The minimum amount for the cash advance is Rs. 500. The bank charges 2.5% of the total transaction with the card.

Fee for Add-On Card– Nil

Limit for Cash Advance – you get 40% of the credit limit for the cash advance.

Repayment Amount– The minimum amount is Rs. 200. You have to pay 5% of the outstanding money.

Fee for Cheque Payment-Rs. 25 for cheque with a value of up to Rs. 5000. Rs. 50 for cheque more than the value of Rs. 5000.

Charges for Payment Return– Minimum amount is Rs. 450. You have to pay Rs. 450. Also, you will be charged 2% of the amount for payment return.

Over Limit Charges– The minimum charge for over limit is Rs. 500 with 2.5% of the amount.

Fee for Rewards Redemption– Rs. 99

Processing Charge for Balance Transfer– 1% of the transfer amount.

Foreign Currency Transaction Charges– 3.5% of the total amount.

Charges for Card Reissuance– Rs. 100.

Fuel Surcharge– The minimum amount is Rs. 450 with a 2% charge of the amount.

Charges for Cash Payment– Rs. 100.

Fee for Railway Ticket– GST charges+ 1% of the amount.

Charges for Late Payment– No charges for a total outstanding amount up less than Rs. 100. Rs. 400 for payment amount between Rs. 100 -Rs. 500.

Rs. 400 for the amount due between Rs. 501-Rs. 5000. Rs. 500 for the amount between 5001-Rs. 10,000. Then, Rs. 700 for the amount Rs. 10,001 to Rs. 25,000. Rs. 750 for the amount due more than |Rs. 750.

These are the important frequently asked questions that will help to clear your doubts about the IndianOil HDFC Bank Credit. Read the following to know more-

Yes, we can use the IndianOil HDFC Credit Card for various purposes. it is specifically designed for travelers to save fuel costs. However, you can get other best offers on other than fuel expenses.

You will enjoy various features that come along with the credit card. There are milestone advantages, discounts on fuel purchase, reward points, renewal fee waivers, and many more.

In this card, you will not receive reward points. The points that you will collect are called Fuel Points. with these fuel points, you can enjoy cash backs and other purchases as well.

Yes, you can use the IndianOil HDFC Bank Card for other purposes as well. You can use the card for grocery shopping and many more.

Yes, the primary applicant can apply for an add-on credit card. The age of the add-on card applicant should be at least 15 years or above. You can use this card for your family members such as mother, father, sister, brother, wife, daughter, and son.

Yes, you can easily use the IndianOil HDFC Card for cash withdrawal as well. The bank will charge 2.5% of the total amount as a cash withdrawal fee. Along with that, you can use the card at various domestic and international ATMs all around the world.

The existing customers and the ones who don’t have an account with the bank can also apply for a credit card. The customers must submit the following documents to apply for the Indian Oil HDFC Card- Identity Proof- Adhaar Card, Driving License, Passport.

Address Proof- Voter ID Card, Ration Card, Electricity Bill, Passport, Adhaar Card.

Income Proof- PAN Card, Salary Slip, ITR Copy of past six months, Form 16. The bank can also ask for additional documents during the application process. After verification, you have to wait a few weeks to get confirmation about your application.

Yes, you also get milestone benefit with the HDFC IndianOil Credit. In this category, if your annual spends reaches Rs. 50,000 then the renewal fee of Rs. 500 will be waived off. You will get several options to get reward points and get free fuel.

The users of this card enjoy discounts on fuel spends of up to 5% as Fuel Points. With this card, you can get around 250 Fuel Points at any petrol pump of Indian Oil across India in the initial six months.

Along with that, you will get 1 Fuel Point with every spent of Rs. 150 with the card. However, the users can also do bill payments and grocery spends as well.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior