Doctor’s SBI Credit Card

Doctor’s SBI Credit Card review: The only card with IMA association with huge welcome benefits & cashback offers. Read the article & apply here.

Doctor’s SBI Credit Card review: The only card with IMA association with huge welcome benefits & cashback offers. Read the article & apply here.

Doctor’s SBI credit card is the only credit card associated with the prestigious Indian Medical Association(IMA). Recently, the State Bank of India launched this SBI credit card in association with Indian Medical Association.

Doctors are warriors who are always ready to help individuals suffering from sickness as well as from deadly infections like Coronavirus. To assist those healthcare workers financially and enable them to save on their daily purchases, here is an exceptionally beneficial credit card facility in the form of SBI doctor’s credit card.

| Joining Fee/ Renewal Fee | Rs 1499 + GST (Renewal fee waived on 2 Lakh spends in a year) |

| Welcome Voucher | Rs 1500 from Yatra |

| Reward Points | 5 points on every rs. 100 spent on travel, medical supplies, Doctor’s day |

| Milestone Benefits | Yatra, Bata, Shoppers Stop voucher worth 5000 |

| Professional Indemnity Insurance | Rs. 10 lakhs insurence at zero cost |

| Airport Lounge Access | Complimentary 4 international & 8 domestic |

This credit card has been developed keeping in mind the spending behavior of the doctors. It comes up with numerous features and benefits, be it travel benefits or advantages on international expenditures. The doctors, moreover, are eligible to get a whole lot of reward points on their medical supplies and other travel and overseas spends.

This SBI credit card becomes yours at an annual fee of Rs. 1,499. The same becomes your renewal fee for the upcoming years as well. This means you can renew the tenure of the card usage by paying Rs. 1,499 every year. If you exceed an annual expenditure limit of Rs. 2 lakhs, the annual fee to be paid for the following year would be waived. Doesn’t it sound great?

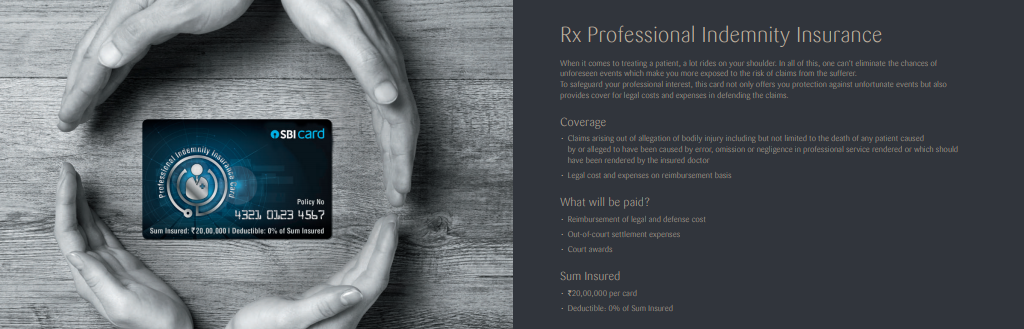

Plus, for the doctors, a professional indemnity insurance cover worth Rs. 10 lakh is available if they own this Doctor’s SBI card. This cover keeps them off from the professional risks and also offers legal and defense coverage.

Download the official brochure here.

Want to compare with other credit cards? Visit Compare Credit Cards Benefits.

The first and foremost feature of this card is that it is completely contactless. Today, when making a transaction or cash advance is risky as you have to come in contact with the person helping you swipe the card using their POS mechanism, this card for doctors keeps them safe. Yes, they can simply wave the card in front of the card reader and make the payment for their purchases.

The Doctor’s SBI card lets you make fast payments. As the payment occurs only at one wave, the users do not have to wait for someone else to collect their card and swipe the same for payment. The cardholders themselves wave the card and things are done.

This SBI card keeps doctors one step ahead towards a cashless society. They do not need to carry cash to buy anything. In fact, even if they forget their wallet by mistake, they don’t need to worry as their credit card will be there to help irrespective of the amount payable. Whether they buy something worth Rs. 100 or Rs. 1 lakh, their card would work for anything to everything.

This SBI card never leaves your hand. Thus, you can use it safely and securely. As you will never require handing it over to anyone for the transaction to be made, there is no chance of it being misplaced or misused. Even if the card is waved more than once, the unique security key feature keeps off the transaction from happening more than once.

This Doctor’s SBI card is accepted in both national and international outlets. More than 24 million outlets accept this card, including 3,25,000 Indian stores.

For the doctors, the banks are always available. In case, this credit card gets misplaced or damaged, you can instantly apply for a replacement. The best part is that you can get the card replaced irrespective of the location you are in. You can get it replaced anywhere in the world during an emergency.

The Doctor’s credit card does not only safeguard the financial interests of the primary cardholders but also makes available add-on cards for the immediate family members of the users. It can be your parents, spouse, children, or siblings. The only thing you need to ensure before applying for the add-on cards is that the family member is 18 or above in age.

Using this card, you can withdraw cash whenever and wherever you require. It works in more than a million Visa/MasterCard ATMs across the world.

This feature allows you to convert your expenditure into easy monthly installments. If you spend Rs 2,500 or more using your Doctor’s credit card, the EMI conversion will be available.

If you pay your utility bills, including electricity, phone, DTH, etc. using this credit card, you save a lot and also get a chance to enjoy additional benefits.

Like any other prestigious credit card, this Doctor’s SBI card also allows you to accumulate all your outstanding credit cards or other dues in one place and convert the overall amount into EMIs, and that too at a lower interest rate. This will make repayment an easy affair for you.

To get your own money to your doorsteps, you can use this SBI credit card. It gets the required amount in the form of a draft or cheque against your cash limit and delivers the same to your doorstep for further use.

The benefits of this SBI credit card include the following:

The connection of the Indian Medical Association is more than enough to show how this card could serve the financial requirements of the doctors who keep on working for the well-being of the people. This SBI card for doctors is the only credit card that has a name like IMA associated with it.

The doctors owing this card are subject to receive insurance coverage worth Rs 20 lakhs. You, therefore, get a chance to reimburse all legal and defense expenses in addition to other costs, including out-of-court settlements, etc.

As soon as the credit card application is approved by the bank, you will receive multiple e-gift vouchers from the bank as a welcome present, including a voucher worth Rs. 1,500 from Yatra.com. All the users receive the e-voucher details on their registered mobile number or email ID. You will have to choose your voucher options within 15 days of the annual fee payment. You can redeem the code online at the time of purchase.

You will receive attractive reward points for using this SBI credit card. You can enjoy 5X reward points on travel bookings, overseas expenses, and medical supplies purchases. Plus, the doctors are celebrated with 5X reward points on Doctor’s Day celebrated worldwide on July 1. For every Rs. 100 purchase, you will be subject to receive one reward point. When you collect 4 reward points, it becomes equal to Re. 1.

You will get the best presents from the bank for using this SBI Doctor’s credit card in the form of an e-gift voucher worth Rs. 5,000 from Yatra.com/Shoppers Stop, bata, etc. You will be eligible for this milestone present only if your annual expenditure reaches or exceeds Rs. 5 lakhs.

The next significant benefit is that if your annual expenditure exceeds Rs. 2 lakhs, you won’t have to pay the renewal fee for the following year.

The Visa privileges you are likely to enjoy include:

You get 4 complimentary visits per year to international airport lounges, which includes a maximum of 2 visits per quarter. This SBI credit card gives you access to more than 1000 airport lounges worldwide. In addition, you can visit Indian airport lounges 8 times a year, which will include a maximum of 2 visits per three months.

Fuel Surcharge Waiver

Get a 1% fuel surcharge waived with this doctor’s credit card from SBI. You can enjoy this benefit at any petrol pump across the nation. The only thing you need to make sure of is purchasing fuel worth Rs. 500 to Rs. 4,000 to have an opportunity to receive this fuel surcharge waiver benefit. Remember that the maximum waiver limit is Rs. 250 per statement cycle for each credit card account.

To be eligible to apply for this Doctor’s SBI card:

You can also check the eligibility criteria more accurately. The steps are as follows:

While applying for this SBI credit card, you need to make sure to accompany the application with the following documents:

However, the State Bank of India might ask for some other document as applicable for advanced verification.

There are two ways of applying for the Doctor’s SBI card – one is through the official website of SBI and another is through us – roopya.com.

Using Roopya

Using SBI official website

In addition, the interested people can SMS ‘DOCTOR’ and send it to 5676791. The representative will call them and discuss the further proceedings.

Once you apply with all the documents attached, you will receive an application ID using which you can track your application status.

The credit limit to enjoy the benefits of the SBI Doctor’s credit card is decided by the bank. If the bank finds it suitable, it allows the doctors to own this card given they fulfill the eligibility criteria.

The State Bank of India launched this SBI credit card in association with Indian Medical Association, or IMA. This credit card has been developed keeping in mind the spending behavior of the doctors. It comes up with numerous features and benefits, be it travel benefits or advantages on international expenditures. The doctors, moreover, are eligible to get a whole lot of reward points on their medical supplies and other travel and overseas spends.

The Doctor’s SBI card is one of the best credit cards for doctors as it offers numerous benefits to the doctors with respect to travel benefits. welcome offers, insurance coverage, medical supplies purchase, etc.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior