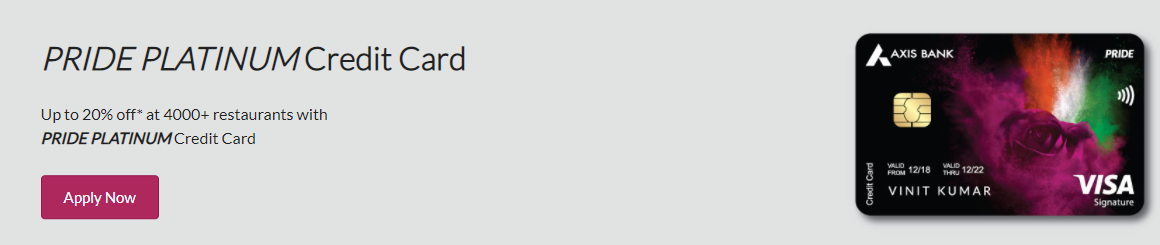

Axis Bank Pride Platinum Credit Card

Axis Bank Pride Platinum Credit Card offers edge points exclusively for Indian army veterans. It also offers a zero joining fee with Rs.250 annual fee.

Axis Bank Pride Platinum Credit Card offers edge points exclusively for Indian army veterans. It also offers a zero joining fee with Rs.250 annual fee.

Do you want to get personalized benefits from your credit card? Then, Axis Bank has bought a special credit card to give a special experience for the customers belonging to the Navy, Indian Airforce, and Army. So, if you are a defense personnel, then this is the best Axis Bank Credit Card. Let’s know more about the Axis Bank Pride Platinum Credit Card-

The Pride Platinum Credit Card by the Axis Bank is loaded with various key benefits for you to enjoy. These are the key features of the Axis Bank Pride Platinum Credit Card-

You get a fuel surcharge waiver of 1% on every fuel. The transaction should be between Rs. 400 to Rs. 4000. However, you can enjoy this benefit up to Rs. 250 every month.

Axis Bank offers the customers of the Pride Credit Card to convert their transactions into EMI. So, if you are a Platinum Pride credit cardholder you can convert the transactions of your retail purchases into EMIs.

Axis Bank offers free add-on cards for the family members of the Axis Bank Pride Platinum Credit Card holders.

This is a personalized credit card for the personnel working in the Armed Forces, Air Force, and Indian Navy with shades of the Indian Tricolour. The Axis Bank Pride Platinum Credit Card is embodied with the color of the Indian National Flag making it look different from other credit cards.

Want to compare? Visit Compare credit cards.

These are the benefits of the Axis Bank Pride Platinum Credit Card that you can enjoy-

On the transaction of Rs. 200, you will get 4 points with the Axis Bank Pride Platinum Credit Card. Also, you will get 100 edge reward points for making purchases of more than Rs. 5000 in every month.

You can redeem these reward points by purchasing products that are available in the rewards catalogue section.

The Axis Bank Pride Platinum Credit Card users can also enjoy lounge visits. They are eligible for 2 free visits to the lounge at select domestic airports in a quarter.

You will also get the benefit of zero lost card liability. It means that you don’t have to worry if your card gets stolen, or transactions made after that. But, as soon you discover that your card has been stolen, you will have to immediately inform the Bank.

With the Axis Bank Pride Platinum Credit Card, the defense personnel will get a 15% discount in about 200 partner restaurants in India.

It is very easy to redeem reward points from mobile and net banking. These are the steps that you need to follow to redeem the edge loyalty reward points through net banking-

With these easy and few simple steps, you can redeem the Reward Points and enjoy the various benefits by redeeming the points.

The credit limit is decided totally by the bank. There are various factors that affect the credit limit such as annual income, ongoing debts, Credit score, credit history, repayment habits, and many more. So, it is very important to have a good credit score to get Axis Bank Pride Platinum Credit Card.

These are the following eligibility criteria that you need to meet if you want to apply for Axis Bank Pride Platinum Credit Card-

The primary cardholder’s age should be at least 18 years of age or above. Also, the maximum age to apply for the Axis Bank Pride Platinum Credit Card is 70 years.

The applicant should be an Indian Citizen. Also, the NRIs or Non- Resident Indians can also apply for the Pride Platinum Credit Card.

If you want to apply for an add on card for any family member, then their age should be at least 15 years or above.

It is important to submit the right documents to apply for the Axis Bank Credit Card. You will need these documents to apply for the Axis Bank Pride Platinum Credit Card-

Identity Proof

Residential Proof

Income Proof

Annual Fee– Rs. 250 starting from the second year. The annual fees will be waived if you spend above Rs. 20,000 in the first year.

Joining Fee– Nil

Fee for Cash Payment– Rs. 100.

Fee for Card Replacement– Waived

Fee for Cash Withdrawal– The minimum amount for cash withdrawal is Rs. 250. Axis Bank charges 2.5% as a cash withdrawal fee on the total amount.

Hotlisting Fees– Nil

Finance Charges– You have to pay 2.95% as Finance Charge for Axis Bank Pride Platinum Credit Card.

Dishonour Fee– The charge for Dishonour Fee is Rs. 300.

Charges for Balance Enquiry-Waived

Outstation Cheque Fee– Waived

GST Charges– According to the regulations by the Government

Foreign Currency Transaction Charges- You will have to pay 3.50% as Foreign Currency Transaction Fee on the total amount.

Copy Request Fee-Waived

Overdue Penalty or Late Payment Charges– No charges for payment up to Rs. 100. Rs. 100 for payment between Rs. 101-Rs. 300. Rs. 300 for payment ranging between 301-Rs. 1000. Rs. 500 for payment between Rs, 1001 to Rs. 5000. Rs. 600 for payment of Rs. 5001 to Rs. 20,000.Rs. 700 for payment more than Rs. 20,001.

Railway Ticket Surcharge– According to IRCTC.

What are the benefits of the Pride Platinum Card of Axis Bank?

The personnel who belong to the Indian Defence Forces such as Indian Airforce, Indian Navy, and Indian Air Force. They get maximum benefits such as edge loyalty points, dining delights at partnered restaurants, fuel surcharge, and many more.

Can police personnel apply for Axis Bank Pride Platinum Credit Card?

No, police personnel cannot apply for the Credit Card Axis Bank Pride. It is exclusively for the people working under the defence welfare association.

What are the Finance Charges of Credit Card Axis Bank Pride?

Axis Bank Charges 2.95% as finance charges every month.

Can I convert purchases into EMIs with the Axis Bank Pride Platinum Credit Card?

yes, the customers of Axis Bank Pride Platinum Credit Card can convert purchases into EMIs. If you spend Rs. 2500 or above with this credit card, then you can convert them into EMIs.

What are the charges for fuel transactions?

The fuel transaction charge is 1% om the total amount with the Axis Bank Pride Platinum Credit Card for fuel purchases between Rs. 400 to Rs. 4000. Also, its maximum benefits is limited to Rs. 250 per month.

How to report to the Axis Bank if I have lost the Credit Card?

If you lose your Axis Bank Pride Platinum Credit Card, then you should immediately contact the bank. You can dial the toll-free number 1860-500-5555 or 1860-419-5555 to report the loss of your credit card.

Metal with a heart of Gold Celebrating the altruist in you with

Ultimate convenience and comfort with a lifetime-free premium Credit

Experience what a premium card can really do. Enjoy a superior